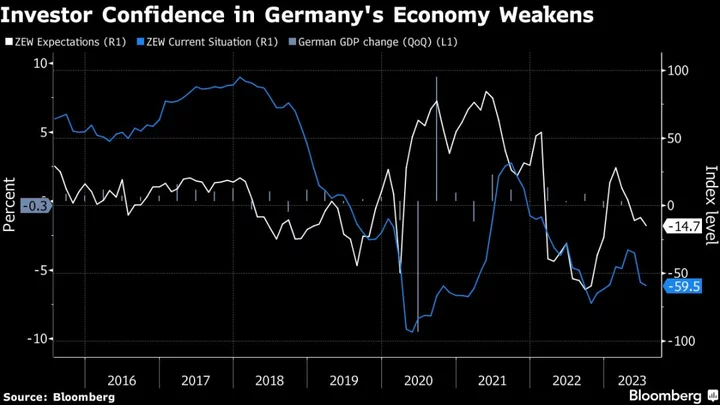

Investor confidence in Germany’s economy declined in July, adding to signs that it’s struggling to gather momentum following a winter recession.

The ZEW institute’s gauge of expectations decreased to -14.7 from -8.5 in June — a worse outcome than economists in a Bloomberg poll had predicted. An index of current conditions also fell.

ZEW President Achim Wambach noted a more noticeable shift in sentiment into negative territory, citing expectations of rising global interest rates and weak export demand in China.

“Industrial sectors are likely to bear the brunt of the anticipated economic downturn, with profit expectations for these export-oriented industries experiencing a substantial decline once again,” he said Tuesday in a statement.

Concerns about the ability of Europe’s biggest economy to rebound from the downturn it endured in the six months through March have grown recently, owing largely to weakness in its outsized manufacturing sector.

Industrial production fell in May, suggesting the factory slump is still weighing on overall expansion and raising the risk that the contraction stretched into the second quarter. While services have been the driver of economic activity of late, growth in that sector moderated last month, according to business surveys by S&P Global.

Inflation continues to weigh: Data released earlier Tuesday confirmed that German consumer prices jumped 6.8% from a year ago last month — quicker than May’s pace.

Such trends have prompted the European Central Bank to extend what’s already the most intense bout of monetary tightening in its history. Policymakers in Frankfurt are set to raise borrowing costs again on July 27 and may do so beyond the summer. They’ve also tried to dispel expectations that rates will be cut anytime soon.

The ECB can get inflation under control without causing severe damage to the euro-zone economy, according to Bundesbank President Joachim Nagel.

“I’m convinced that we can manage it in a way that the economy weakens a bit, but that there won’t be a hard landing and high unemployment,” he said Monday.

--With assistance from Joel Rinneby and Kristian Siedenburg.