German football fans are gearing up for a dramatic showdown this weekend, when the Bundesliga title race will be decided on the final day of the season. For the first time since 2012, the country’s richest club Bayern Munich looks set to lose out to archrival Borussia Dortmund.

Ending Bayern’s decade of dominance would chisel away at the narrative that Germany’s top football competition has become a boring affair lacking the appeal of the UK’s Premier League or Spain’s LaLiga. But critics point to another watershed decision in Germany this week — one that may prevent Bundesliga clubs from getting the kind of billion-dollar outside investments that have boosted their rivals in recent years.

Germany’s professional football body DFL on Wednesday failed to win enough backing from clubs for its plan to raise as much as €2 billion ($2.1 billion) selling Bundesliga media rights to private equity investors. CVC Capital Partners, Blackstone Inc. and Advent International were said to be among parties interested. The push faltered because clubs including Hamburg’s FC St. Pauli, whose fans have deep links with the city’s punk scene, expressed strong reservations. While the DFL saw an opportunity to raise cash and bolster the league’s international allure, critics feared that a deal would benefit mainly those teams already on top while allowing a creeping influx of ruthless investors.

“Clearly, the Bundesliga is reluctant to enter into a globalizing football race where clubs risk being uprooted from their home town,” said Francois Godard, a media analyst at Enders Analysis. “This may make sense, but to be successful it calls for domestic reforms to enhance the competitiveness of the Bundesliga, to make it more exciting, less predictable.”

European football has seen an unprecedented influx of investment in the past two decades. Much of it has gone to the Premier League, which has charged ahead thanks to lucrative broadcast deals and a liberal ownership structure that has been welcoming to homegrown billionaires, American buyout firms and oil-rich nations with questionable human rights records.

Abu Dhabi’s money has helped Manchester City forge a dominant position, with the team winning the league five times in the last six years. Newcastle United this week qualified for Europe’s top club competition, the Champions League, in only its second season under Saudi-backed ownership. Private equity group Clearlake Capital joined forces with US billionaire Todd Boehly for the £4.25 billion ($5.25 billion) takeover last year of London’s Chelsea FC from the sanctioned Russian oligarch Roman Abramovich.

Read More: Billionaire Turns From Finance to Living Out His Inner Ted Lasso

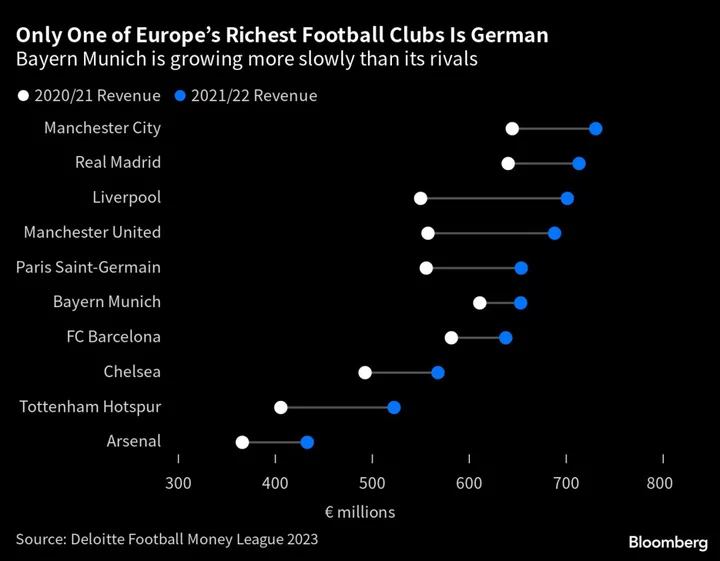

In Germany, strict ownership rules have managed to keep foreign investors largely at bay. The country’s clubs have complained they’re at a disadvantage competing for players with the likes of Premier League clubs and Paris Saint-Germain, whose Qatari funding has helped it attract superstars Lionel Messi and Neymar. Of the German teams, only Bayern has managed to win the Champions League since the start of the millennium, lifting the trophy three times. Three English clubs share five victories, while Spain’s Real Madrid has won six titles on its own.

Enders Analysis labeled Germany a “lagging market” in a recent report, with broadcasting revenue down 7% for the 2021-25 period compared with the previous cycle. The 20-team Premier League is expected to generate over €7 billion in revenue during the current season, compared to €3.6 billion from the 18 members in the Bundesliga’s top division, according to Stefan Ludwig, head of the sports business group at Deloitte.

Still, private-equity investments were always going to be controversial in Germany, where fans co-own clubs and carry significant sway over strategic decisions. Italy’s Serie A walked away from a similar broadcasting rights deal after opposition from teams, while CVC’s multi-billion-euro investment in Spain’s LaLiga sparked criticism from heavyweights FC Barcelona and Real Madrid.

Proponents of the German way say it has helped keep player salaries in check and ticket prices low compared with leagues where investors spent freely but also presided over escalating costs for fans. The Bundesliga boasts the highest attendance in Europe, with several arenas including Dortmund’s Signal Iduna Park expected to sell out on Saturday when the team faces Mainz 05. A win would secure them the title.

Dortmund and Bayern were among clubs that backed the private-equity deal, arguing the Bundesliga needs additional funding to keep pace with rival leagues that are expanding abroad and at home. Manchester United’s US owner, the Glazer family, has been getting bids in the region of £5 billion for the team from investors including British billionaire Jim Ratcliffe and a Qatari sheikh.

“The clubs who expressed their opposition very loudly — and in some cases also fed their fans arguments that weren’t really based on good knowledge and objectivity — will have to answer one question,” said Axel Hellmann, a DFL executive. “Where will the Bundesliga get its security and stability from in the future?”

--With assistance from Eyk Henning.