Germany’s economy exited recession by the slimmest margin in the second quarter but its sluggish performance continues to drag down growth across the whole euro zone.

Output stagnated in the three months through June, data showed Friday, matching an initial estimate and the median forecast in a Bloomberg survey.

The causes are sluggish global growth — which caused a slump in German exports — a steep manufacturing downturn and consumers rocked by soaring inflation and the aggressive interest-rate increases enacted to bring it back to 2%.

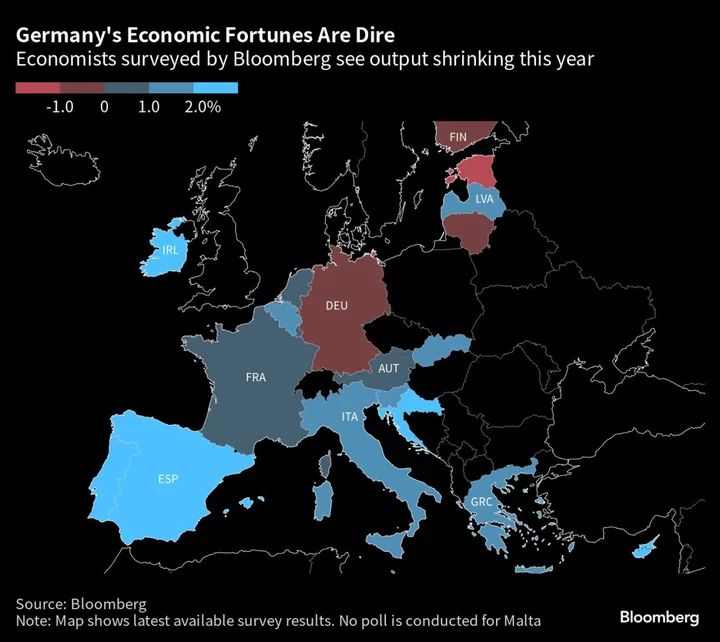

The report is unlikely to quell concerns that Europe’s largest economy — once the region’s trade-fired growth engine — is facing a protracted period of weakness. Germany is the only major country forecast to shrink this year, and the outlook is gloomy.

Industry had the worst month in half a year in June, and factory orders — a gauge for future activity — barely increased in the second quarter.

This week brought more signs of weakness as S&P Global’s Purchasing Managers’ Index for August fell to 44.7 — the lowest in more than three years, with services shrinking for the first time in eight months.

A separate poll from S&P revealed similar struggles for the 20-nation euro area, prompting investors to bet that the European Central Bank will pause its unprecedented campaign of rate hikes next month.

Firms in Germany are sounding the alarm.

Hamburger Hafen saw a steep decline in shipping volumes extending into the second quarter and warned last week that it expects a “significant decrease” in revenue at its Port Logistics subgroup. Russia’s war in Ukraine, geopolitical tensions, inflation and rising interest rates put pressure on consumer and industrial demand, hindering the global economic recovery, it said.

Meanwhile, Siemens AG’s earnings fell short of analyst estimates as the company faced a drop in demand for its digital industries unit in China. And Salzgitter, one of Europe’s largest steelmakers, also reported weaker-than-expected results and suggested output will be weaker in the second half than in the first.

The Bundesbank said this week that the economy will probably stagnate this quarter as well as high interest rates and weak global demand weigh on manufacturing. At the same time, a robust labor market, strong wage gains and moderating inflation will underpin a revival in consumer spending.

Such sentiment was reflected in a third straight decline in business confidence in July, prompting Clemens Fuest, whose Ifo institute compiles the report, to speculate that the economy may still be in recession. Economists predict another drop this month when data are released later Friday.

--With assistance from Kristian Siedenburg and Joel Rinneby.