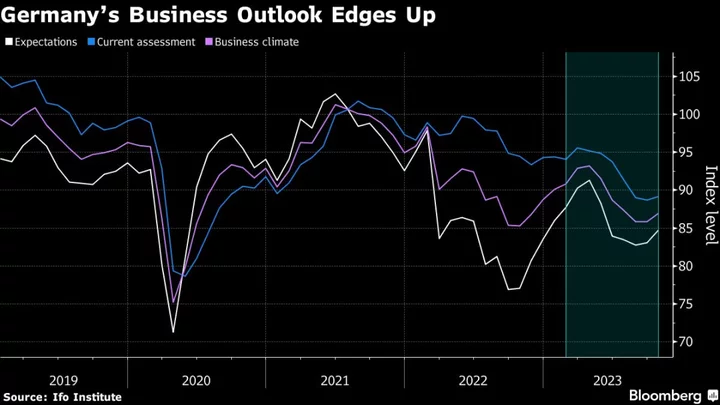

Germany’s business outlook improved slightly, supporting expectations for Europe’s largest economy to rebound modestly — even as it faces a possible second recession in just over a year.

An expectations index by the Ifo institute rose to 84.7 in October, up from a revised 83.1 the previous month. That beat the median estimate in a Bloomberg survey for an increase to 83.5. A measure of current conditions unexpectedly advanced.

“What we see here does suggest that we see a certain stabilization,” Ifo President Clemens Fuest told Bloomberg Television on Wednesday. “The German economy will be shrinking this year, but for the final quarter we do expect a stabilization, slight growth.”

Germany hasn’t recorded expansion in more than a year and economists are less optimistic than Fuest, predicting a contraction in the six months through December due to the energy crisis, weak Chinese demand and higher interest rates.

The key manufacturing sector continues to struggle. Chemical giant Lanxess AG announced last week that it will cut 7% of its workforce in Germany due to energy shortages and cratering global demand — adding to previously announced redundancies at BASF SE. Citing cost issues and supply disruption, Volkswagen AG has cut guidance.

“The positive numbers are mostly coming from the service sector,” Fuest said. “So it’s sectors like IT and tourism.”

What Bloomberg Economics Says...

“The uptick in Germany’s business outlook suggests the economy remains sluggish but may be passing the nadir. After a technical winter recession, the economy stagnated in the second quarter of this year. We expect it contracted in 3Q23 as higher interest rates and weaker global demand weigh on it. Still, things may be stabilizing further out. There are signals the services sector is steadying, helped by the prospect of rising disposable incomes.”

—For full note, click here

Business surveys released Tuesday by S&P Global offered little solace, showing private-sector activity contracting at a steeper pace this month than in September. There were also signs of weakness in the labor market, which had been a bright spot.

More deep-seated challenges, like a rapid aging of Germany’s workforce and the need to diversify trading relationships away from China, point to only feeble expansion in the coming years. Comparisons with the 1990s, when Germany was labeled the “sick man” of Europe, have also emerged.

Top officials — including Finance Minister Christian Lindner and Bundesbank President Joachim Nagel — have pushed back against such suggestions, saying German industry can overcome the challenges it’s facing.

Fuest said looser monetary policy could offer a boost to the economy in 2024.

“There might even be room for interest-rate cuts next year — maybe in the second half of next year,” he said before Thursday’s European Central Bank policy meeting. “But I certainly wouldn’t advise the ECB to raise rates.”

--With assistance from Kristian Siedenburg, Joel Rinneby, William Wilkes, Dani Burger, Jana Randow, Craig Stirling and Laura Alviž.

(Updates with Bloomberg Economics after sixth paragraph.)