Germany’s emergency spending freeze is blocking funds for next-generation auto-industry and steel plants, jeopardizing the push to re-engineer Europe’s economic engine.

Berlin halted new spending authorizations this week after Germany’s top court ruled that some €60 billion ($65.7 billion) can’t be transferred into a green-technology fund. The money was earmarked for a range of projects including decarbonizing steel production and major semiconductor works led by Intel, TSMC and Infineon.

Sweden’s Northvolt AB was also due to receive part of pledged subsides from the climate fund for an EV battery plant in northern Germany, according to two people familiar with the situation.

The bombshell court ruling, catching the government seemingly unprepared, is putting Germany in danger of falling behind in the global race for green technologies, according to Claudia Kemfert, professor of energy economics at the DIW research institute in Berlin.

We “have already lost large parts of this competition, and now we are also in danger of losing it in electromobility, digitization and green hydrogen for heavy industry,” Kemfert said. “This is particularly painful as Germany gave the go-ahead for the energy transition 20 years ago and was the global market leader for many years.”

Read more: German Budget Crisis Deepens With Freeze on New Spending

The budget chaos adds to decades of flawed energy policy, the demise of combustion-engine cars and excess bureaucracy hitting Europe’s biggest economy. Germany is forecast to be the weakest alongside Italy among major euro-zone nations this year, and the spending issues are sowing further uncertainty.

As Germany struggles for a path toward net zero, deepening cracks among its storied industrial leaders are starting to show. Siemens Energy AG pledged additional cost cuts on Tuesday after multiple shocks related to its wind turbine unit wiped billions of euros off its market value. Car-parts makers including Continental AG are cutting thousands of jobs to reduce costs as the industry transitions to EVs. Thyssenkrupp AG has so far failed to find a buyer for its steel business that’s draining the company’s cash balance.

Last week’s ruling cast doubt on Germany’s entire financing plans, and senior officials have canceled some public appearances to deal with the upheaval. Germany’s DAX index is little changed since the government announced the spending freeze on Monday.

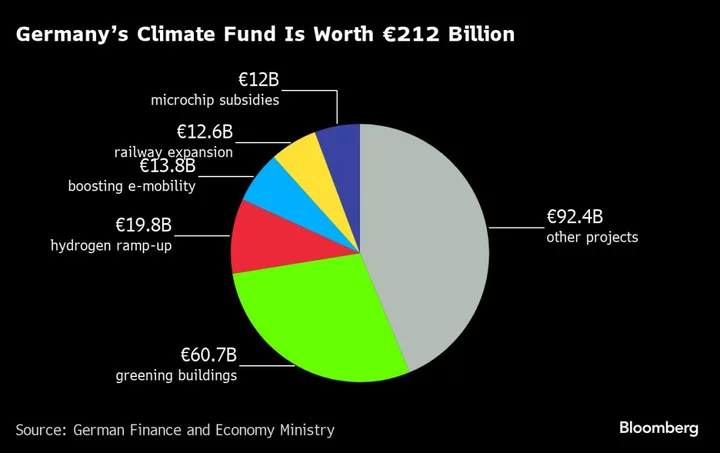

Germany’s KTF climate and transformation fund foresees around €212 billion in spending through 2027 for private households and industry — including some €58 billion next year that are now on hold. The ruling and subsequent chaos stand in sharp contrast to US President Joe Biden’s Inflation Reduction Act that is attracting scores of companies with unprecedented spending on future technologies.

“These investments do not stand alone, but are embedded in a network of economic ties,” Economy Minister Robert Habeck said Tuesday. “The ruling of the Constitutional Court and then the implementation of the KTF budget freeze means that only those who have a formal funding decision can be sure that the money will flow.”

While the government hasn’t commented on specific projects, the spending freeze could complicate its plan to buy Germany’s largest power grid from state-owned Dutch operator Tennet Holding BV for just over €22 billion.

Berlin also promised some €20 billion in aid to bolster local chipmaking in a push to shore up the country’s tech sector and secure supplies amid growing geopolitical tension. The money is earmarked for projects including a €10 billion Taiwan Semiconductor Manufacturing Co.-led factory in Dresden and a €30 billion Intel Corp. chip plant in Magdeburg.

The court decision and the uncertainty that has followed jeopardizes Germany’s reputation among semiconductor companies, a senior industry official said, declining to be named because he was not authorized to speak on the matter. Chip factories take years to plan and build, and companies active in Germany have long risked starting a project before getting final aid approval, the official said.

Companies are hoping for a swift resolution. ZF Friedrichshafen AG is planning to build a $3 billion wafer factory in Saarland with Wolfspeed Inc. to supply the EV industry. The project is funded roughly a quarter with European Union as well as German federal and local aid. The company said Tuesday it still expects to receive the money promised by Germany to go ahead with the project.

“A quick, pragmatic and legally secure solution is necessary,” a spokesman for the company said. “Now it is up to politicians to join forces for Germany and create a successful industrial and green transformation.”

Much-needed upgrades for Deutsche Bahn AG, Germany’s fledgling hydrogen industry and its electric-vehicle infrastructure are also affected. Prior to last week’s ruling, trucking executives including Daimler Truck AG’s Karin Radstrom had pointed to a slow build out of charging points as the main bottleneck in the transition to low-emission vehicles.

The KTF had earmarked €4.5 billion next year for the EV transition, including for charging points for cars and trucks. The spending is to help Germany reach its goal of halving transport emissions by the end of this decade, compared to 2019 levels.

“The climate protection support for freight transport is already undersized,” said Frank Huster of the DSLV logistics association. Without the necessary public spending, “decarbonizing logistics will come to a halt before it has really begun.”

--With assistance from Monica Raymunt and Wilfried Eckl-Dorna.

(Updates with Tennet deal in 11th paragraph.)