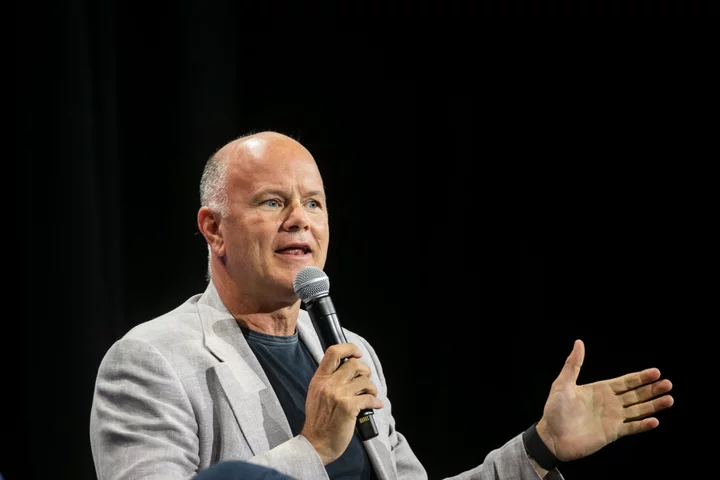

Michael Novogratz doesn’t expect US lawmakers to make headway on regulating the crypto sector before the 2024 election, speaking ahead of anticipated approval by the Securities and Exchange Commission of the first American exchange-traded fund to directly hold Bitcoin.

“I don’t think anything gets done this side of the election. But there are plenty of smart guys in Washington,” Novogratz, the founder and chief executive officer of Galaxy Digital Holdings Ltd., said on the New York-based company’s third-quarter earnings conference call Thursday.

He also predicted that the Federal Reserve would opt to cut interest rates in the first quarter of next year, which when combined with subsequent crypto regulation, would further support the industry’s growth over the next 18 months. The SEC is expected to approve a spot Bitcoin ETF by Jan. 10, according to Bloomberg Intelligence analysts, though some anticipate that the watchdog could greenlight a fund as soon as this week.

The absence of sector-specific legislation that puts rules around the growing crypto industry has led to an uptick in enforcement action from US authorities over the last year, keen to crack down on what they view as rampant speculation on digital assets with little to no investor protections in place. The collapse of several high-profile businesses in the space has also served to dampen asset prices, leaving liquidity and volumes largely diminished.

Galaxy reported a net loss of $94 million in the third quarter, compared with about $68 million in the same quarter a year earlier, citing soured token prices fell and record lows in market volatility. The company had previously posted a loss of around $46 million in the second quarter, with consensus estimates previously forecasting that third-quarter losses would hold broadly steady at $44 million.

Galaxy, which offers businesses ranging from crypto trading and asset management to mining, reported trading revenue of $14 million in the quarter, a decrease of $6 million from the second quarter. This was despite a 70% increase in trading volume over the same period, with its average loan book size expanding to $553 million.

But the company said its financial situation had improved significantly since the quarter ended, recording $124 million in income before tax and $24 million in trading revenue in the month of October. This was driven primarily by its position in the market and the appreciation of digital asset prices, it said, with assets like Bitcoin having jumped in price by nearly 30% that month.

“It’s been a hard 18 months of building and lower volumes, each employee to keeping their own morale up,” Novogratz said on the call. “Our results in the third quarter weren’t great. In the first month, we already made that up and then some, and we’re off to a good November.”

Read: Novogratz Says Some Institutions Are Coming Back to Crypto (1)

Shares of Galaxy, which had almost doubled this year prior to the earnings release, traded up 10% on Thursday. Novogratz has previously said he expects the SEC will approve a Bitcoin ETF by the end of 2023, after Galaxy partnered with Invesco on plans to launch such a product.

“2024 is going to be a year of institutional adoption, primarily through the Bitcoin ETF,” he added on Thursday. “As institutions get more comfortable, as the government gives its seal of approval that Bitcoin is a thing, you’re going to see the rest of the allocators starting to look at things outside of that and so money will flow into the space. It will probably take until 2025 for all this investment in tokenization and wallets really start to show up.”

Read: Novogratz Reiterates He Expects Bitcoin ETF Approval in 2023 (1)

Management and performance fees from Galaxy’s asset management business were $4.7 million in the third quarter, representing an 11% quarterly increase. Meanwhile preliminary assets under management were reported at approximately $3.9 billion as of Sept. 30, a 58% increase on the second quarter.

The business recorded an impairment expense of $44.9 million on its minority interest in Galaxy Digital Holdings LP during the period, it said. This was compared to a reversal of impairment of $128.1 million recognized in the first and second quarters of this year.

(Updates to add comments from earnings call, beginning in the first paragraph.)