More junk-rated companies are likely to default on their debt as the US economy slows, according to Franklin Templeton portfolio manager Benjamin Cryer, who is waiting for wider spreads before buying the bonds.

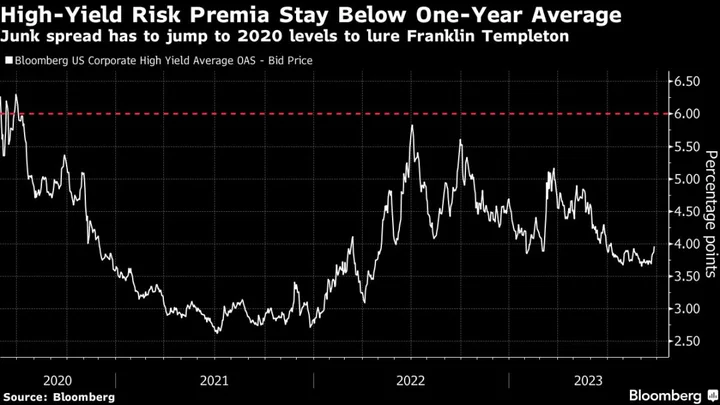

The $1.4 trillion asset manager, which is currently underweight US high yield, may add exposure if spreads start to price in distress and widen to 600-700 basis points over Treasuries, according to Cryer. That compares to a spread of 393 basis points on Wednesday.

“We don’t see growth falling off a table, which does create opportunities for below investment-grade sectors,” Cryer said in a interview Tuesday. “To the extent that the market gets more pessimistic, that’s when we would look to get more in an overweight position.”

A debt market correction may occur as the US labor market and growth deteriorate, boosting defaults from risky companies which haven’t yet felt the impact of higher rates, according to Cryer. Any recession would likely be relatively shallow and would therefore be unlikely to cause a big spike in missed payments, he added.

Fears of a US slowdown haven’t deterred yield-hungry investors. Junk bonds have held up well, delivering a 5.6% gain this year, even as Treasuries and US investment-grade notes sank into losses.

If the US avoids recession altogether next year, there will be opportunities to buy more cyclical names and lower-quality bonds, said Cryer. He co-manages the Franklin Strategic Income Fund which has returned 2.5% this year, outperforming 81% of its peers.

“There certainly is risk in the high-yield market. But you know, I think we view it generally as good risk,” said Cryer.

Fitch Ratings Inc. said in May it expected defaults to rise for the remainder of the year on constrained liquidity and tighter lending conditions. A looming wall of about $1 trillion in junk debt maturities over the next three years leaves riskier corporates no option but to refinance.

US Junk-Bond Funds Post the Biggest Outflow in Seven Months

Funds that invest in US corporate high-yield bonds suffered the biggest weekly cash exit since February as concerns that interest rates will stay higher for longer continue to mount.

(Updates with junk bond flow data)