The French government will expand obligations for profit-sharing to include large companies conducting share buybacks, in a move that adds a layer of complication to the practice without enforcing extra fixed costs or taxation.

A government amendment to the 2024 finance bill would oblige a firm with more than 50 workers that buys back shares and then cancels them to negotiate with unions for one-off payments to employees via existing profit-sharing mechanisms, a Finance Ministry spokesperson said. Such obligations are already being prepared in separate legislation covering companies that record so-called exceptional profits.

“If you have the means to do share buybacks, you have the means to give your workers a raise,” Finance Minister Bruno Le Maire said on Tuesday on BFM Business television. “This is a question of fairness and recognizing labor.”

Last month, TotalEnergies SE said it would boost share buybacks to $9 billion this year. Accor SA said on Oct. 10 that it was starting a €400 million ($423 million) share buyback, in line with the hotel operator’s commitment to return €3 billion to shareholders over the 2023-2027 period.

The new obligation would enact a pledge President Emmanuel Macron made early this year as he sought to defuse anger over pension reform with a promise for a better deal for workers.

The French leader has often turned to profit-sharing formulas — first developed by Charles de Gaulle — to respond to worker anger without compromising his low-tax, pro-business policies.

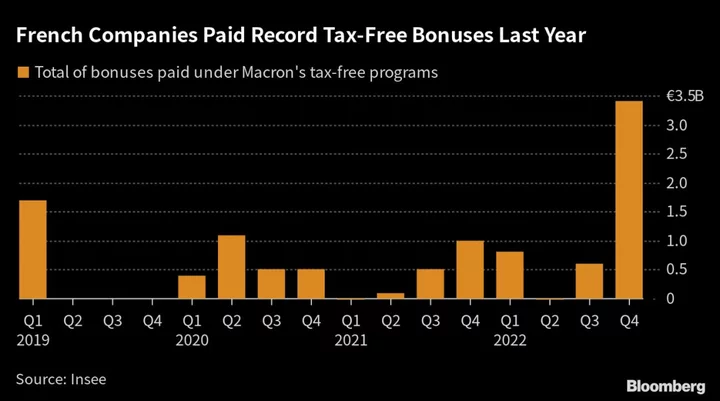

In 2019, he introduced a tax-free bonus mechanism for workers as part of several measures intended to placate the Yellow Vest protesters. The finance ministry official said the so-called ‘Macron bonus’ could also be used by companies doing buybacks to meet any new obligations.

The exact magnitude of profit-sharing and which mechanism a company uses would be subject to negotiations with employee representatives and labor unions.

Le Maire said only a few dozen companies would ultimately be affected by any new rules and no new taxes would be introduced. Share buybacks are already taxed in France, he said.

“The government line and the president’s line for the last six years has been based on supply side policies that create jobs and open factories,” Le Maire said. “It’s out of the question to change this economic policy.”

--With assistance from Tara Patel.