As France mobilizes 45,000 police officers to quell rioting across the nation and Wagner’s forces regroup in Belarus, an ominous summer is building in Europe. Here’s what’s coming up in Asia this week.

The big pause. In Asia, the central banks of Australia, Malaysia and Sri Lanka have rate decisions coming up and all three are likely to pause. The Bank of Japan’s Tankan survey could show a small improvement in sentiment, but the BOJ may also stay on hold at its meeting this month. In China, though, the Caixin manufacturing PMI could slip back into contraction, in another sign of export weakness.

The big data. US employment numbers are key this week, with economists predicting more moderate yet still healthy job growth, an historically low unemployment rate, cooler wage gains and fewer vacancies, pointing in general to a soft landing for the world’s biggest economy.

The big gas. China is buying liquefied natural gas as if the energy crisis will never end, signing more multi-decade contracts than any other nation and building a string of import terminals along its coast. It could become the world’s top LNG importer as soon as this year, while the US will soon become the top exporter of the fuel. Let’s see how that works out.

The big miscalculation. Britain’s largest water supplier, Thames Water, is struggling to deal with its more than $17 billion of debt because of its small mountain of inflation-linked bonds. But the drowning utility isn’t the only one to get caught out by the jump in prices and interest rates. There’s more than $1.8 trillion of this kind of debt outstanding worldwide.

The big debate. The trillion-dollar AI stocks rally has rekindled one of the oldest feuds in finance, between the bulls who keep buying to profit from the rally, and those who gape at the gravity defying valuations of soaring securities, convinced that it will all come to a sticky end. Here’s what happens when you put bears in the bull-ring.

The big link. A five-year-old feud between the top bourses in Singapore and India reaches a resolution tomorrow when SGX-traded derivatives worth about $7.5 billion shift to India as a cross-border trading link becomes fully operational.

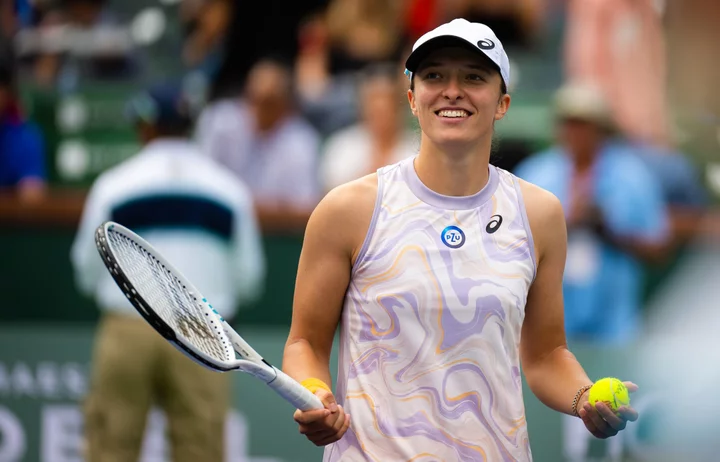

The big serve. Chill the strawberries and cream, Wimbledon is back for the next fortnight. Will Novak Djokovic continue his recent domination of the event? Will Iga Swiatek finally get to hold the Rosewater Dish? Will it pour with rain all week?

Have a rallying week.