Foreign investors are snapping up Saudi stocks after last month’s rush for the exit, as investors weigh attractive equity valuations against the impact of the Israel-Hamas war in the Middle East.

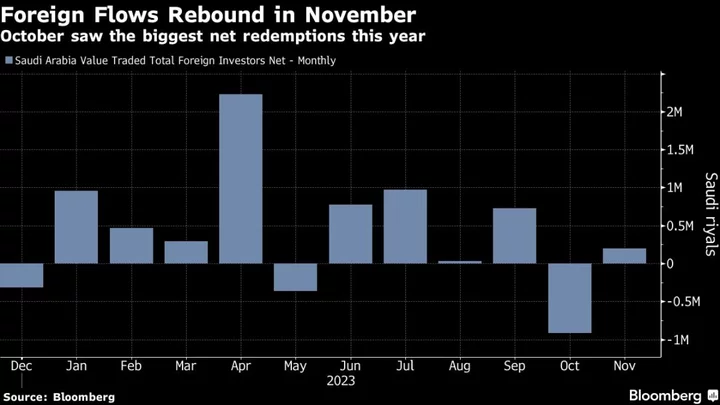

Net inflows have extended for a second week after October saw the largest monthly net redemptions of 2023, according to data from the stock exchange. International traders have bought 12.7 billion riyals ($3.4 billion) of Saudi stocks so far in November, after they sold 26 billion riyals the month prior, resulting in net outflows.

“Valuations in Saudi Arabia are not terribly stretched,” said Christian Ghandour, senior portfolio manager at Al Dhabi Capital. “If market perception of geopolitical risk reduces markedly, we may see more inflows into the regional markets.”

The war between Israel and Hamas weighed on Middle Eastern markets last month, causing Saudi Arabia’s Tadawul All Share Index to erase yearly gains at one point. Risk appetite was hit by concerns that the situation could escalate into a wider conflict. Unstable oil prices and signs of a slowing domestic economy continue to cloud the picture for investors.

Still, the benchmark has since recovered and is up 3.6% this year so far, outperforming the MSCI Emerging Markets Index.

While Saudi Arabia’s gross domestic product shrunk in the third quarter due to a drop in the oil economy after production cuts, the non-oil economy — bolstered by efforts to foster new industries like tourism and manufacturing — recorded gains. The diversification plans, in which Crown Prince Mohammed bin Salman is investing trillions of dollars, have been the main driver of employment.

“Saudi Arabia has a strong fundamental story and significant untapped potential,” said Junaid Ansari, director of investment strategy and research at Kamco Investment Co. “That said, we expect volatility in the near term due to a lot of chaos in the market.”

Ali El Adou, head of investment structuring at Aditum Investment Management Ltd., also expects volatility to stay elevated, given the geopolitical uncertainty. “Keeping exposure to consumer staples, utilities and health care should provide a hedge.”