Bonds tied to biodiversity goals are on track for a record-setting year and this niche area of ESG investing is only going to get bigger, according to Fitch Group Inc.

Biodiversity doesn’t yet attract the same degree of investor attention as climate change. The struggle to bring variety to living species within a region has lacked clear metrics as well as an infrastructure to draw in investments. But the topic is poised to be the “next frontier” in ESG as new policies emerge and corporate and investor interest grows, according to William Attwell, an analyst at Sustainable Fitch.

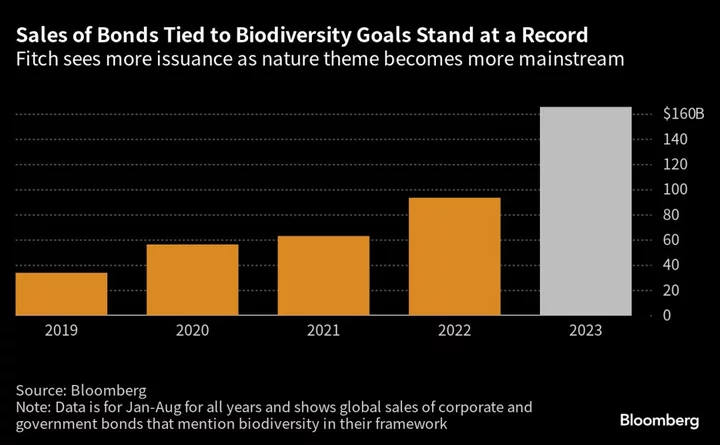

Mounting concern about the deterioration of the environment has boosted sales of bonds that mention biodiversity in their frameworks to a record $165.4 billion globally this year through end of August, according to data compiled by Bloomberg. That’s a 77% jump from the $93.3 billion raised in the same period last year.

“We expect nature to become increasingly mainstream within ESG as the universe of investible assets grows,” wrote Atwell. He sees “a steady rise in issuance of green and sustainability-labeled bonds featuring biodiversity.”

Companies are increasing their pledges to be more “nature positive” while new frameworks are being hammered out globally, which should improve market transparency. That should drive more bond sales, according to Atwell. Several asset managers have already launched dedicated biodiversity and nature-themed funds in recent months as borrowers ramp up sales of bonds related to nature.

The momentum is strongest in Europe, the dominant market for sustainable finance, according to Atwell. This partly reflects strong policy signals on nature restoration from regulators there and growing interest in biodiversity from market participants in the region.

Governments — which play a major role in managing conservation areas — are issuing such bonds, including selling debt-for-nature swap deals, said Atwell. Ecuador in May completed the largest debt-for-nature deal of its kind, a transaction that will generate more than $1 billion worth of savings for the government while helping to protect habitats of the Galapagos Islands.

‘Analytical Challenges’

Nature, nonetheless, poses “unique analytical challenges” for ESG investors. The plethora of nature topics can make it challenging to assess meaningful levels of impact and determine the credibility and materiality of specific targets and plans, while disclosed data remain patchy, said Attwell.

Take Gabon’s $500 million debt-for-nature swap, completed last month to help refinance a small portion of its debt and lock in funds for marine conservation. The transaction, which was Bank of America Corp.’s debut venture into debt-for-nature swaps, proved a bumpy ride. The deal was delayed and the new blue bonds eventually got priced at a higher-than-expected interest rate, which lowered the savings for Gabon and prompted at least one major blue bond investor, Nuveen, to walk away. Nuveen declined to comment further on the deal, BofA did not immediately respond to a request for comment.

Read the QuickTake: Why Biodiversity-Related Investments Are a Tough Sell

Fitch is taking heart from recent policy signals such as the Kunming-Montreal Global Biodiversity Framework (GBF), signed by more than 190 countries at the UN biodiversity conference last year. The framework has prompted a significant increase in policy ambition across jurisdictions, with signatories committing to restoring and conserving 30% of marine and terrestrial ecosystems by 2030.

The framework also aims to mobilize at least $200 billion annually by 2030, including through labeled bonds, wrote the analyst.

--With assistance from Jiayu Liu.