WASHINGTON (AP) — A key Federal Reserve official said Tuesday that he is “increasingly confident” that the Fed's interest rate policies will succeed in bringing inflation back to the central bank's 2% target level.

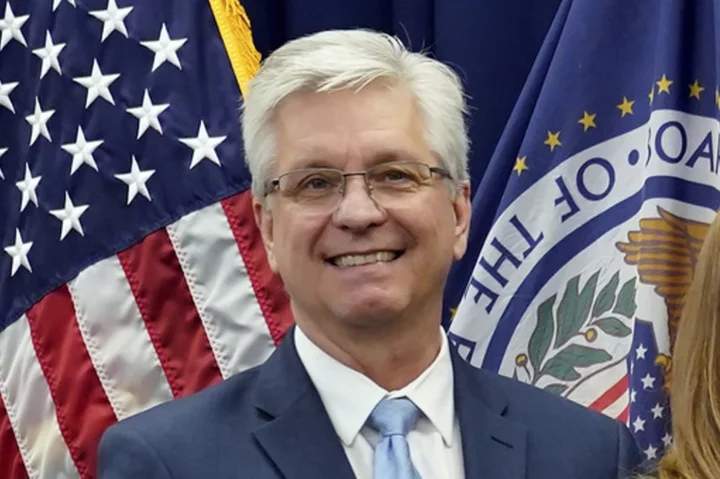

The official, Christopher Waller, a member of the Fed's Board of Governors, cautioned that inflation is still too high and that it's not yet certain if a recent slowdown in price increases can be sustained. But he sounded the most optimistic notes of any Fed official since the central bank launched its aggressive streak of rate hikes in March 2022, and he signaled that the central bank is likely done raising rates.

“I am increasingly confident that policy is currently well-positioned to slow the economy and get inflation back to 2%,” Waller said in a speech at the American Enterprise Institute, a Washington think tank.

Waller's remarks follow Chair Jerome Powell's more cautious comments earlier this month, when Powell said “we are not confident” that the Fed's key short-term interest rate was high enough to fully defeat inflation. The Fed has raised its rate 11 times in the past year and a half to about 5.4%, the highest level in 22 years.

Inflation, measured year over year, has plunged from a peak of 9.1% in June 2022 to 3.2% in October. Waller said October's inflation report, which showed prices were flat from September to October, “was what I want to see.”

Waller noted that recent data on hiring, consumer spending, and business investment suggested that economic growth was cooling from its torrid 4.9% annual pace in the July-September quarter. Slower spending and hiring, he said, should help further cool inflation.

Last month's figures "are consistent with the kind of moderating demand and easing price pressure that will help move inflation back to 2%, and I will be looking to see that confirmed in upcoming data releases,” Waller said.