Federal Reserve staff have become more wary about the risks that elevated asset prices pose to financial stability after a run-up in the stock market in recent months.

They judged asset-valuation pressures to be “notable” at the Fed’s July 25-26 policy meeting, according to minutes of the gathering published Wednesday. That was a step-up in concern from their assessment of “moderate” risks in May, when they last made a financial-stability presentation to the Federal Open Market Committee.

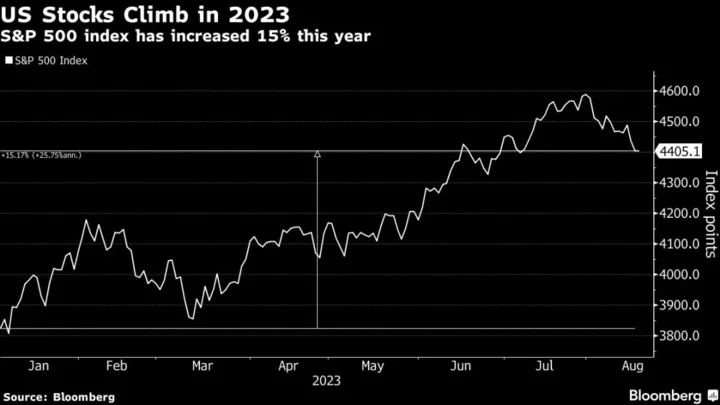

Since then, stock prices have advanced, though they’ve given up some of those gains this month as companies have reported second-quarter earnings and bond yields have risen.

In trying to ascertain risks to the stability of the financial system, the Fed focuses on a number of variables, including the health of the banking system and the amount of leverage in the economy as well as asset-price valuations.

When those prices are elevated and out of line with fundamentals, the concern is that sudden or steep declines could disrupt the workings of the financial system and thus hurt the economy.

That’s what happened some 15 years ago, when the bursting of a house-price bubble drove the economy into what was then its deepest downturn since the Great Depression. That prompted the central bank to ramp up surveillance of financial-stability risks.

Fed staff present policymakers with a detailed assessment of financial vulnerabilities at every other meeting of the FOMC, when the quarterly Summary of Economic Projections is not on the docket.

Read More: Fed Saw Upside Inflation Risk That May Merit More Tightening

In their review of the financial situation in July, the staff noted that broad stock-price indexes had increased and corporate bond spreads had narrowed going into the meeting, according to minutes. Overall, they characterized financial-stability risks as notable.

Among other factors, they cited residential and commercial property prices, calling them “high relative to fundamentals.” House prices have begun to rise again and price-to-rent ratios are near those seen in the mid-2000s, before the bursting of the mortgage-market bubble, according to the minutes.

Commercial real estate prices have declined, but a shift toward more work from home may portend further notable drops ahead, the staff suggested.

In their July discussion of financial-stability risks, Fed policymakers also flagged the danger of “a potential sharp decline in CRE valuations that could adversely affect some banks and other financial institutions, such as insurance companies,” the minutes said.