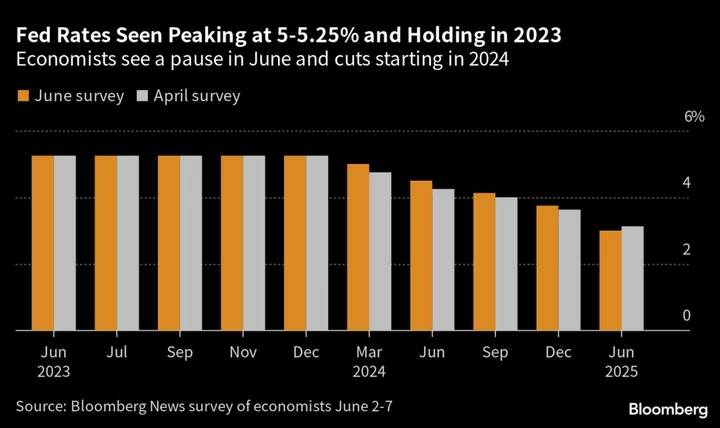

Most economists expect the Federal Reserve to pause interest-rate increases next week for the first time in 15 months and leave policy on hold through December, even as it confronts a resilient US economy and persistent inflation.

The Federal Open Market Committee will keep rates steady at its June 13-14 meeting at the 5%-5.25% range, though officials face a closer call in July on what to do, according to economists surveyed by Bloomberg.

Chair Jerome Powell had hinted at a suspension of the tightening campaign last month, suggesting that he favored waiting to evaluate the lagged effects of past moves and the impact of recent bank failures on credit availability.

The FOMC’s median projection in its quarterly “dot plot” Summary of Economic Projections is expected to show the policy benchmark at 5.1% at the end of 2023 – identical to what the economists expect the actual rate to be and in line with the March projection. By contrast, markets are pricing in a quarter point hike in July, with a similar-sized cut possible in December.

The survey of 46 economists was conducted June 2-7.

“We expect a hawkish pause at the June FOMC meeting, with the FOMC choosing not to hike, but signaling an expectation of additional hiking through the SEP,” said Nomura Securities economists Aichi Amemiya, Jeremy Schwartz and Jacob Meyer, in a survey response.

“We expect May will end up representing the last hike of this cycle, as easing inflationary pressure, a slowing of labor conditions, and headwinds from reduced lending lead the FOMC to not later decide to resume hiking,” they added.

What Bloomberg Economics Says

“The Fed most likely will refrain from hiking rates at its June 13-14 meeting. That’s because the more influential FOMC participants – most of all, Fed Chair Jerome Powell – believe previous tightening, which will work through the economy with a lag, will induce more weakening in the months ahead. But Powell may face a revolt on the FOMC.”

— Anna Wong, Stuart Paul, Eliza Winger and Jonathan Church (economists)

Credit tightening in the aftermath of the failures of Silicon Valley Bank and Signature Bank in March has led Fed leaders to emphasize uncertainty about the outlook for the economy and flexibility on how they will respond.

Still, the data so far has surprised to the upside, and policymakers will upgrade their forecasts for the economy for this year, according to the economists. They are likely to pencil in growth prospects of 0.6% this year, up from 0.4% officials saw in March, and lower the expected unemployment rate at year’s end to 4.2% from 4.5% seen in March.

They are likely to view the overall inflation outlook as unchanged at about 3.3% for this year, and 3.7% excluding food and energy, or 0.1 percentage point higher than March. The Fed targets 2% inflation measured by the personal consumption expenditures price index, which rose by 4.4% in April and has been higher and more persistent than forecast for much of the past year.

The economists are split on whether the Fed has reached its peak rate, with about a third expecting a quarter-point hike in July. A number of the more hawkish Fed officials have called for higher rates, including St. Louis President James Bullard and Cleveland’s Loretta Mester, and some have raised the possibility of skipping a meeting and tightening over the summer.

“In the face of stronger-than-expected data the leading officials of the FOMC have indicated that they are inclined to skip the June meeting though it does not preclude them from tightening in July,” said Kathy Bostjancic, chief economist at Nationwide Life Insurance Co. “The guidance from the Fed has become muddled and is confusing to the markets.”

With inflation slow to return to target, the Fed’s leaders are likely to project rates will remain high throughout 2024 ending the year at about 4.4%.

Even when the Fed reaches a peak rate, almost all of the economists agree the central bank will continue to shrink its balance sheet as part of an ongoing program to normalize its assets. Two thirds think the FOMC will continue to shed assets even after it starts to cut interest rates, which is seen to occur in the first quarter of 2024.

While Powell has said he sees a narrow path for a soft landing, the Fed staff has predicted a US recession and 63% of economists see a downturn as likely in the next 12 months. Most of the rest see a hard landing with a period of contraction or zero growth that falls just short of a formally declared downturn. Among those predicting a downturn, the vast majority expect it to begin in the third or fourth quarters.

“The Fed has gotten itself in a tough position of attempting to calibrate a blunt tool,” said Diane Swonk, chief economist at KPMG LLP in Chicago. “It will likely face headwinds as it struggles to communicate what a soft landing actually means.”

Nearly 40% of economists expect a dissent at the meeting, which would be a break from the mostly unified votes in recent years by the Powell Fed. Minneapolis Fed President Neel Kashkari, Dallas Fed President Lorie Logan and Governor Christopher Waller, all of whom are seen as hawks pushing for higher rates, are the most likely to oppose a pause.

While Fed policy has drawn criticism from both those who believe the Fed was too slow to address high inflation or that current tight policy will put millions out of work, the economists judged monetary policy is about right at present with the median economist agreeing with the current rate as the ideal terminal rate.

“The U.S. economy is on a path for continued decent growth with rapidly declining rates of inflation,” said economic forecaster James Smith of EconForecaster LLC.