Federal Reserve officials shifted their tone this week, inching closer to the conversation markets have long been having: When will the central bank begin cutting interest rates?

A litany of policymakers — including six who will vote on policy next year — indicated in recent days that they were comfortable with keeping rates steady at their December meeting, encouraged by the downward trend in inflation and data showing a slowing economy.

Though Fed officials showed little interest in discussing rate cuts, markets quickly latched onto comments by Governor Christopher Waller. An inflation hawk closely followed by Wall Street, Waller acknowledged the Fed would consider trimming rates if inflation continues to fall, in line with typical policy guidelines central bankers use.

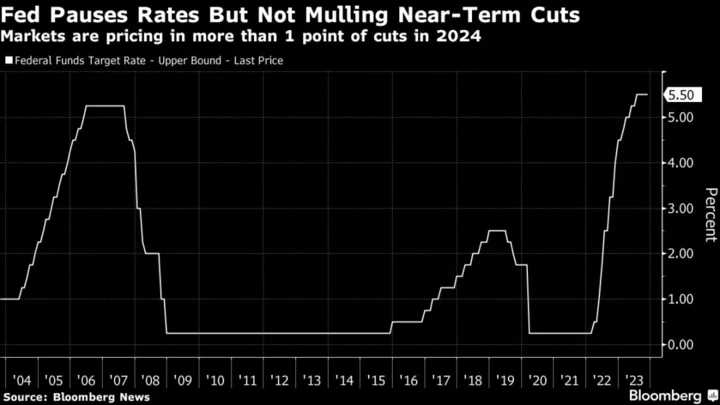

Fed Chair Jerome Powell, who is set to speak at Spelman College in Atlanta on Friday, is much more likely to reiterate that it’s too soon to declare victory than discuss rate cuts. Concern over a potential renewed bout of inflation is likely to keep the Federal Open Market Committee forecasting much higher interest rates in 2024 than the four quarter-point cuts priced in by markets.

“Powell will be cautious not to pop champagne corks but the mantra will soon shift from higher for longer to higher for long enough,” said Diane Swonk, chief economist at KPMG. “Inflation has come down more rapidly than they expected and that means that they are likely to pencil in more cuts than they were willing to in September.”

The odds of a quarter-point cut at the FOMC’s March meeting have risen to that of a coin toss, with markets now fully pricing in a cut in May. They see more than a full point of cuts by the end of next year. Conversely, Fed officials projected rates at 5-5.25% at the end of 2024, according to their median forecast released in September — just one-quarter point lower than the current level.

Some Wall Street predictions are even more bold. Deutsche Bank, which is forecasting a mild recession next year, reiterated its view this week that the Fed is likely to begin to cut in June and reduce rates by a total of 175 basis points through year-end. Billionaire investor Bill Ackman sees the central bank cutting rates as early as the first quarter of 2024.

“The expectations for Chair Powell to opine on rate cuts have clearly risen in light of the recent comments” from Waller, said Yelena Shulyatyeva, senior US economist at BNP Paribas. “He may not go as far as to firmly validate a new dovish tone.”

“After all, the Fed’s target is not necessarily achieving a soft landing; it is getting inflation back to the 2% target,” she said.

Recent inflation news has been upbeat. The core personal consumption expenditures price index, which strips out the volatile food and energy components, rose 0.2% in October. And headline inflation advanced at an annual pace of 3%, the slowest since 2021.

What Bloomberg Economics Says ...

“The October personal income and spending report shows why FOMC members are increasingly confident that rates are sufficiently restrictive. ... The momentum is for disinflation to continue through at least mid-2024, when core PCE inflation likely will fall below 3%.”

— Anna Wong, Stuart Paul and Eliza Winger

For the full note, click here

That said, policymakers remain concerned that progress on inflation could stall or even reverse. Two officials – Richmond Fed’s Thomas Barkin and Fed Governor Michelle Bowman – said as much, raising the possibility of additional hikes if inflation proves to be stubborn.

Kathy Jones, Charles Schwab’s chief fixed income strategist, doesn’t see Powell opening the door to rate cuts in the first quarter, noting he will will probably try to avoid providing any kind of time frame. “But he’ll probably reflect satisfaction with the way things are going – inflation is falling and unemployment is staying low.”

Here’s a summary of the key comments from Fed officials this week:

Governor Christopher Waller, 2023-24 voter

“If inflation’s coming down, once you get inflation down low enough, you don’t necessarily have to keep rates up at those levels... if we see this inflation continuing for several more months — I don’t know how long that might be, three months, four months, five months — that we feel confident that inflation is really down and on its way, that you can then start lowering the policy rate just because inflation’s lower.”

Governor Michelle Bowman, 2023-24 voter

“I remain willing to support raising the federal funds rate at a future meeting should the incoming data indicate that progress on inflation has stalled or is insufficient to bring inflation down to 2% in a timely way.”

Cleveland Fed President Loretta Mester, 2024 voter

“Monetary policy is in a good place for policymakers to assess incoming information on the economy and financial conditions and judge whether policy is well calibrated to ensure that inflation is on a timely path back to 2%.”

New York Fed President John Williams, 2023-24 voter

Rates are “estimated to be the most restrictive in 25 years. I expect it will be appropriate to maintain a restrictive stance for quite some time to fully restore balance and to bring inflation back to our 2% longer-run goal on a sustained basis.”

Richmond Fed President Thomas Barkin, 2024 voter

“If inflation comes down naturally and smoothly, awesome. ... But if inflation is going to flare back up, I think you want to have the option of doing more on rates.”

Atlanta Fed President Raphael Bostic, 2024 voter

“I’m sensing greater clarity about a few important currents. One is the direction of inflation. There’s no question the rate of inflation has slowed materially over the past year-plus, and thus far we have avoided a disruptive surge in unemployment that often accompanies a steep slowdown in price increases.”

Chicago Fed President Austan Goolsbee, 2023 voter

“Overall, we have made progress on inflation outside of the food sector. It’s been coming down. It’s not yet down to target. But 2023, we’re on a path to set the highest drop in the inflation rate in 71 years.”