By Howard Schneider

ATLANTA (Reuters) -Federal Reserve officials see rising yields on long-term U.S. Treasury debt as evidence their tight-money policies are working, but for now at least say they are not triggering alarm bells for the economy.

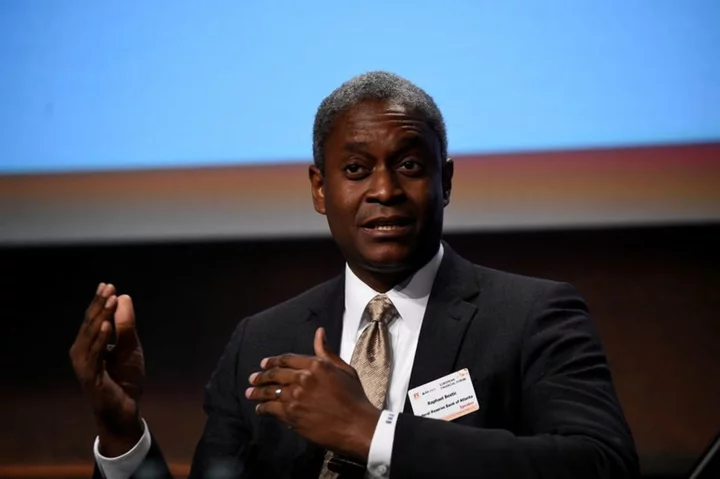

Atlanta Federal Reserve President Raphael Bostic agreed the comparatively fast recent rise in the market interest rates paid on U.S. Treasury bonds, something that feeds through to a variety of important business and household borrowing costs, was "complicated," and "kind of a funny thing" that was outside how those rates usually respond to Fed policy.

Since July's quarter-point increase in the Fed's policy rate, a short-term benchmark that influences the yields on a variety of securities, yields on the 10-year Treasury note and 30-year bond have shot up by roughly 1 percentage point to their highest levels since the 2007-2009 financial crisis.

But Bostic said that for the Fed what matters is how such changes in financial conditions impact how consumers and firms invest and spend - and so far that appeared to be along the lines of what would happen "in an ordinary tightening cycle."

"Tighter financial conditions is part of what our policy is trying to create. It needs to translate into changes in economic outcomes," Bostic said in comments to reporters alongside the release of a new policy essay.

"I don't think the degree of response to date has been out of bounds," he said.

But he also said that he thinks the Fed needs to enter the next period with a "patient" approach to any further rate increases in part because he feels the economy is still adapting to the 5.25 percentage points of rate hikes imposed since March of 2022. Part of that adaptation is how the Fed's short-term benchmark is translated ultimately into mortgage rates, corporate bonds yields, and other securities that influence economic activity.

Bostic said he does not favor further rate increases in part to allow more time to determine just how fast the economy will slow based on the evolution of financial conditions.

In separate comments, Cleveland Fed President Loretta Mester said she similarly is watching how the rise in bond yields will play out, even though she feels the Fed's policy rate still needs to rise.

"We're going to have to follow that and watch it and that will influence not only our policy decisions, but how the economy evolves," Mester said. "Over the next year, those tighter or higher rates will have an impact on the economy and we just have to take that into account when we're setting monetary policy."

A LOT GOING ON

The outsized rise in longer-term yields, which could raise financing costs for businesses and leave consumers with more expensive mortgages and loans, has sent economists scrambling to understand what's in play - whether it is a response to rising U.S. debt, for example, changes in bond purchases by international actors like China, or concerns about global inflation and growth dynamics.

"There is a lot going on and I cannot say I have all the answers," Bostic said.

It may well be that the Fed's hawkish rate posture is no longer the primary impetus for the rise in yields.

Apollo Global Management Chief Economist Torsten Slok, for one, sees so-called term premiums - a gauge of how much compensation investors demand for holding long-term debt - coming back into influence after years of being largely absent.

The New York Fed's widely followed measure of the 10-year Treasury term premium has popped above zero for the first time in about two years.

In a note last week, Slok rattled off half a dozen reasons for the jump in yields and related term premium rise, only one of which he laid at the feet of the Fed: Its ongoing balance sheet reduction in which more than $1 trillion of bonds - including about $800 billion of Treasuries - have matured out of its portfolio.

Other likely culprits include the August downgrade of the U.S. government's credit rating by Fitch Ratings, the growing federal budget deficit, and the aggressive pace of bond issuance by the Treasury Department. He also lists the Bank of Japan's recent signals of a pending policy shift and the weakness of China's economy, which has left it fewer dollars to recycle into a Treasury market that it was already shying away from.

(Reporting by Howard Schneider and Dan Burns; Editing by Andrea Ricci)