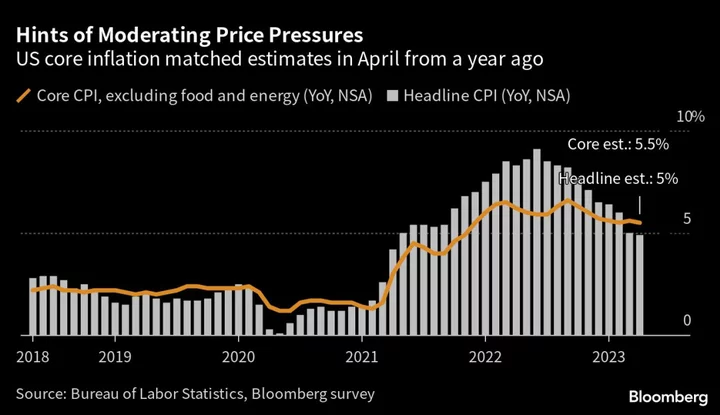

Signs of moderating price pressures in April will give Federal Reserve officials room to pause their aggressive tightening campaign next month, though inflation is still running too hot for policymakers to consider cutting interest rates.

The consumer price index rose by 4.9% from a year earlier, the first reading below 5% in two years, a Bureau of Labor Statistics report showed Wednesday. Excluding food and energy, the so-called core consumer price index also cooled slightly. But perhaps more importantly for the Fed, the report showed a smaller increase in some key service costs, as airfares and hotel costs declined.

“A quick read would indicate a tilt towards some potential further tightening of monetary policy,” said Gregory Daco, chief economist at EY. “But if you lift the cover and look at the underlying details in this report, actually they mostly point towards the higher likelihood of a pause.”

Markets are still looking for the US central bank to cut rates later this year, amid fears that tightening credit in the wake of a string of bank collapses will lead to a marked economic slowdown. But Wednesday’s data suggest officials are still a ways off from declaring victory over inflation.

Policymakers lifted interest rates last week for the 10th straight time, bringing the target on their benchmark rate above 5% for the first time since 2007. Fed officials hinted they want time to assess how the most aggressive tightening campaign since the 1980s is working its way through the economy.

While inflation has been the driving factor behind the Fed’s rapid rate increases over the past year, officials have indicated that the impact from tightening credit is likely to weigh heavily on how they proceed as they near the end of their rate-hiking cycle.

Recent strains in the banking system are raising concerns that a looming credit crunch could weigh on the economy and tip it into recession. Policymakers have said the impact is highly uncertain, however, and some have said it could help curb price pressures.

“While the April CPI report isn’t exactly reassuring, it also won’t jolt Fed officials into signaling another rate hike in June, given their expectation that the full disinflationary impact from tighter credit conditions has yet to show up,” said Anna Wong, chief US economist for Bloomberg Economics. “However, the slow progress in reducing core inflation highlights how unlikely it is that the Fed will cut rates this year.”

Credit Crunch

A Fed report out Monday showed that banks reported tighter standards and weaker demand for loans in the first quarter. But the figures suggested the continuation of a trend that began before recent stresses in the banking sector emerged, not necessarily an acceleration of tighter credit conditions.

New York Fed chief John Williams said Tuesday he’ll be closely monitoring how strains in the banking sector affect the US economy, and left the door open to leaving interest rates on hold next month.

Williams also said officials would tighten more if needed to bring inflation down to the Fed’s 2% goal, but pushed back against the expectation that the Fed would be slashing borrowing costs soon.

“I do not see in my baseline forecast any reason to cut interest rates this year,” he said at an event with the Economic Club of New York.

Powell told reporters after last week’s meeting that his forecast is for the US economy to experience modest growth this year, not a recession.

But some other policymakers, including Chicago Fed president Austan Goolsbee, are striking a more cautious tone. “I am certainly getting vibes — as you are — in the market and in the business contacts that the credit crunch, or at least a credit squeeze, is beginning,” Goolsbee said Monday during an interview on Yahoo! Finance.

(Updates with more context in sixth paragraph.)