A Federal Deposit Insurance Corp. meeting on Thursday to vote on how to refill the deposit insurance fund was scrapped as political pressure mounted over allegations of workplace misconduct.

The agency had scheduled a public vote on a plan to charge banks more fees to refill the fund after it was depleted in March to make whole uninsured depositors at Silicon Valley Bank and Signature Bank. Instead, board members are submitting written votes. The final version tracks largely with a proposal made in May, according to people familiar with the matter.

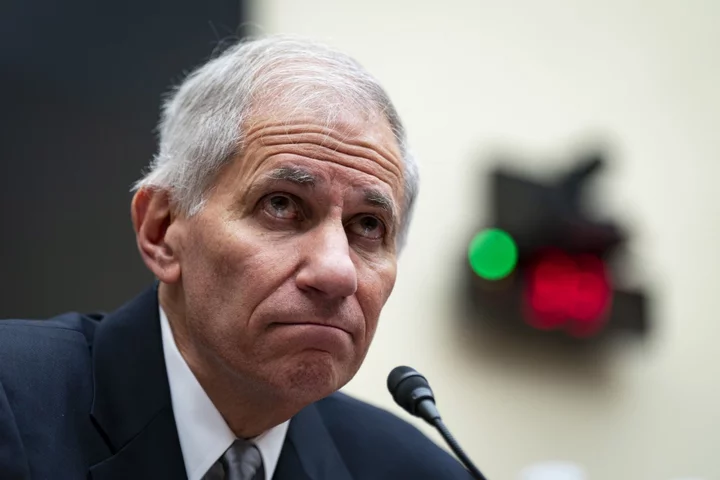

Thursday’s abrupt cancellation coincided with calls from some Republican lawmakers for Gruenberg to step down. A Wall Street Journal article on Monday depicted a misogynistic culture among FDIC bank examiners that prompted women to quit.

Gruenberg told senators on Tuesday that the FDIC is investigating. But another story by the newspaper on Wednesday focused on allegations that Gruenberg’s responses to misconduct have been weak, and on complaints about his temper.

Senator John Kennedy, a Louisiana Republican, said Thursday that Gruenberg should step aside “so that a new chair can restore the professional culture at the FDIC that the American people expect from its institutions.” Kennedy sent Gruenberg a letter demanding his resignation.

A spokeswoman for Gruenberg declined to comment on why the agency had canceled its Thursday meeting. She didn’t immediately respond to a request for comment on the call for Gruenberg to resign.

Insurance Fund

Some in the industry had called on the FDIC to change aspects of the methodology for calculating payments from the fees it proposed to charge banks to refill the US insurance fund. However, the regulators ultimately decided to stick close to its original plan, said one of the people, who asked not to be identified discussing internal deliberations. It’s unclear if that decision would change if Gruenberg were to leave the agency.

In its May proposal, the FDIC said that the extra fees would be collected at an annual rate of about 12.5 basis points over the eight periods. The formula was based on criteria including the amount of a bank’s uninsured deposits.

When it unveiled the plan, the FDIC said institutions with more than $50 billion in assets would pay 95% of the fees, and those with less than $5 billion wouldn’t have to pay.

JPMorgan Chase & Co. estimated in a recent regulatory filing that it would have to pay $3 billion before taxes when the rule is finalized.