The chair of the Federal Deposit Insurance Corporation wants more aggressive oversight of large regional banks.

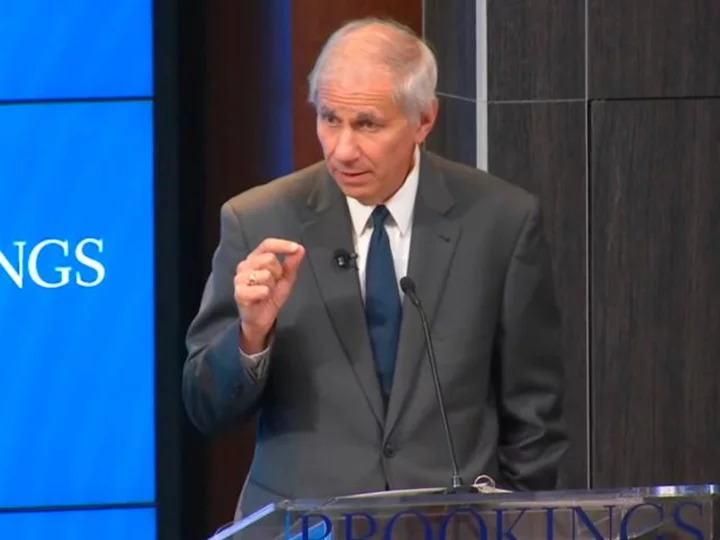

Martin Gruenberg said the FDIC plans to propose a rule that would require banks with more than $50 billion in assets to provide certain information in the contingency plans they're required to submit to regulators, outlining what they'll do in case their institution runs into trouble.

He made the remarks on Monday at an event hosted by the Brookings Institution, in Washington, DC.

The FDIC chief also praised a proposal that would require banks with more than $100 billion in assets to raise more capital to hedge against unrealized losses as they occur. He also touted a proposal that would implement a long-term debt requirement for large regional banks.

His remarks come after the failures of three regional banks earlier this year, which the FDIC took over as mandated by law. That ensured depositors maintained access to their money.

This story is developing and will be updated.