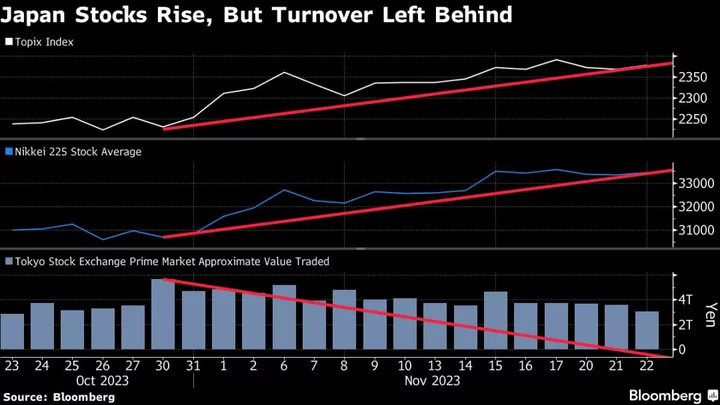

Japanese stocks need new catalysts to decisively breach new 33-year highs as a lack of turnover suggests that investor interest has yet to return.

The daily value of shares traded on the Tokyo Stock Exchange’s Prime Market has been on a decline since reaching a short-term peak at the start of this month, according to data compiled by Bloomberg. That’s despite the Nikkei 225 Stock Average on Monday briefly topping this year’s intraday high.

The recent gains in stocks were driven largely by futures traders unwinding their short positions after the 10-year Treasury yield fell back from 5%, said Kiyohide Nagata, a strategist at Tokai Tokyo Research Institute Co. Equities globally had been under pressure because of nervousness caused by higher bond yields.

The daily trading volume of Nikkei 225 futures reached this month’s high on Nov. 15, the same day the underlying index surged by the most this year. That’s a sign speculative positioning including from hedge funds was behind the gains.

While the stock market tends to rally toward year-end, fresh drivers such as positive economic data will be needed to take further, Tokyo-based Nagata said. Longer term, the value of traded shares is still on an uptrend.