By Jason Lange

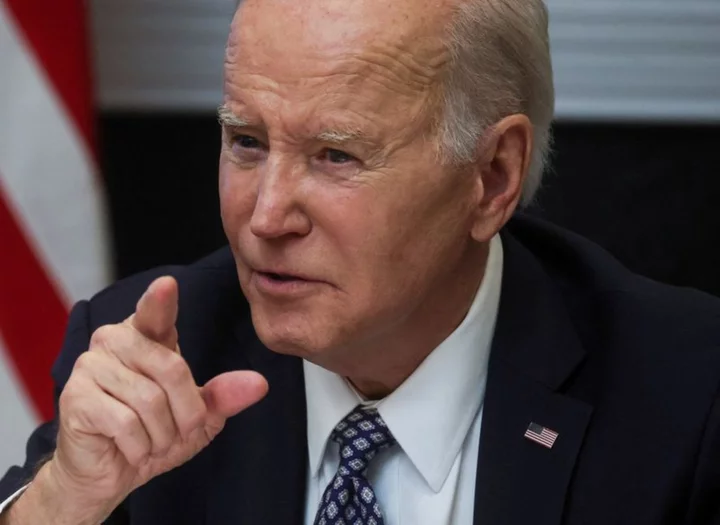

WASHINGTON U.S. President Joe Biden is due to meet on Tuesday with the top Republicans and Democrats in Congress amid a months-long standoff over the government's debt ceiling that has brought the nation close to the brink of default and economic crisis.

WHAT IS THE DEBT CEILING?

Washington regularly sets a limit on federal borrowing. Currently, the ceiling is set at $31.4 trillion, equal to roughly 120% of the country's annual economic output. The debt reached that ceiling in January and the Treasury Department has kept obligations just within the limit by suspending investments in some federal pension funds while continuing to borrow from investors.

The Treasury warned last week that it could have to stop borrowing altogether and rely solely on tax receipts to pay its bills by as soon as June 1, though it also said that cutoff, known as the "X-date" could occur several weeks later.

Because the Treasury borrows close to 20 cents for every dollar it spends, Washington at that point would start missing payments owed to lenders, citizens or both.

IS THE DEBT CEILING GOOD FOR ANYTHING?

Few counties in the world have debt ceiling laws and Washington's periodic lifting of the borrowing limit merely allows it to pay for spending Congress has already authorized.

Treasury Secretary Janet Yellen and other policy experts have called on Washington to eliminate the limit, because it amounts to a bureaucratic stamp on decisions already made.

Some analysts have proposed that the Treasury can bypass the crisis by minting a multitrillion-dollar platinum coin and putting it in the government's account, an idea widely seen as an outlandish gimmick. Others argue the debt ceiling itself violates the U.S. Constitution. But if the Biden administration invoked that argument, which involves the 14th Amendment, a legal challenge would follow.

WHAT HAPPENS WHEN WASHINGTON CAN NO LONGER BORROW MONEY?

Shockwaves would ripple through global financial markets as investors question the value of U.S. bonds, which are seen as among the safest investments and serve as building blocks for the world's financial system.

The U.S. economy would almost certainly fall into a recession if the government was forced to miss payments on things like soldiers' salaries or Social Security benefits for the elderly. Economists expect that millions of Americans would lose their jobs. Already, investors have shunned some U.S. debt securities that come due in July and August as they try to avoid bills maturing when the risk of a debt default is highest.

HOW DID WE GET HERE?

Republicans, who hold a narrow 222-213 majority in the House of Representatives, in late April passed a bill that would raise the debt limit but also set in place sweeping spending cuts over the next decade.

The bill has no chance of approval in the Democratic-controlled U.S. Senate. House Speaker Kevin McCarthy wants Biden to negotiate on spending cuts even as the White House insists on a debt limit increase with no strings attached.

HAVEN'T WE HEARD THIS SONG BEFORE?

This kind of brinkmanship has been part of U.S. politics for decades but worsened significantly after fiscal hawks in the Republican Party grew in power since 2010.

In a 2011 showdown, House Republicans successfully used the debt ceiling to extract sharp limits on discretionary spending from Democratic President Barack Obama.

Spending caps stayed in place for most of the rest of the decade, but the episode rattled investors and led to a historic downgrade of the U.S. credit rating.

(Reporting by Jason Lange; Editing by Scott Malone and Jonathan Oatis)