By Howard Schneider

WASHINGTON A tight U.S. job market and rising wages are beginning to have more of an impact on inflation and could embed faster rising prices if the demand for workers is not brought into better balance with the labor force, new research from an ex-Federal Reserve chief and a former top International Monetary Fund economist has concluded.

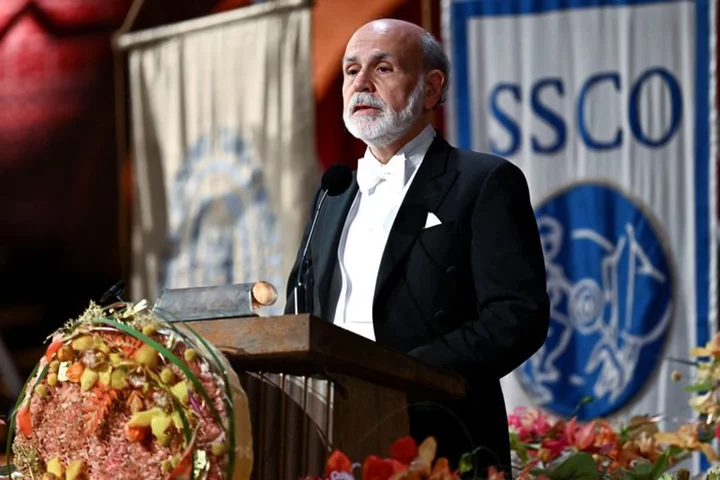

Ben Bernanke, who led the U.S. central bank from 2006-2014, and Olivier Blanchard, the IMF's chief economist from 2008 to 2015, said the inflation surge starting in 2021 was largely stoked by energy markets and shortages of automobiles and other durable goods.

"However, over time a very tight labor market has begun to exert increasing pressure on inflation ... That share is likely to grow and will not subside on its own," they wrote in a paper released on Tuesday by the Washington-based Brookings Institution. "The portion of inflation which traces its origin to overheating of labor markets can only be reversed by policy actions that bring labor demand and supply into better balance."

The U.S. central bank has raised interest rates aggressively since March of 2022 to try to slow the economy and reduce the overall demand for goods and services. While policymakers are expected, for now, to hold off on another rate increase at their June 13-14 policy meeting, they have remained noncommittal as they await upcoming inflation and jobs data.

The paper adds a new set of arguments, from two influential economists who witnessed inflation's broad retreat during their policymaking terms, to one of the Fed's central debates: what role a looser job market and slower wage growth will need to play in any continued lowering of inflation from levels that remain high and are only slowly improving.

LABOR MARKET SLACK

Some Fed economists and policymakers feel a point of steady "disinflation" may be close, and hinges only on families and businesses spending final doses of pandemic-era cash. Others, most notably Chicago Fed President Austan Goolsbee, have argued that wage gains say little about future price increases, but largely reflect past price hikes.

Atlanta Fed economists have cast it differently still, saying that after COVID-19 pandemic years in which businesses saw outsized profits, there is room for wages to grow through a decline in business margins rather than a rise in prices.

In a joint appearance with Bernanke at a U.S. central bank research conference last Friday, Fed Chair Jerome Powell seemed to have settled in a place similar to the former Fed leader, saying that much of the work left to be done in lowering inflation will have to come from a job market still sustaining a 3.4% unemployment rate, abnormally high numbers of vacancies, and wage gains outpacing the rate of price increases.

"I don't think labor market slack was a particularly important feature of inflation when it first spiked in spring of 2021," Powell said. "By contrast, I do think that labor market slack is likely to be an increasingly important factor in inflation going forward," reiterating his observation that price increases are proving most stubborn in service industries where "labor costs are a high proportion of total costs."

A Fed intent on producing weaker hiring and slower wage growth would, at least in the past, imply rising joblessness. Indeed, policymakers expect the unemployment rate to increase as their fight against inflation continues.

How fast and by how much remains a contested point: Some outside economists have estimated unemployment rates as high as 6% or 7% will be necessary, while Fed policymakers remain hopeful of a more modest dislocation.

Bernanke and Blanchard did not take an explicit stand on that issue, but said it may still be possible for the labor market to ease largely through a drop in the number of job openings rather than a rise in joblessness.

INFLATION EXPECTATIONS

Their study, however, points to some of the risks Fed officials may face as they decide whether to be patient in allowing time for inflation to slow, or use further rate increases to force a faster adjustment in an effort to ensure high inflation does not become embedded.

Bernanke and Blanchard estimate that inflation could return to the Fed's 2% annual target if over the next two years their preferred measure of labor market slack - the number of job openings for each unemployed job seeker - falls below 1 to around 0.8, meaning more unemployed workers are competing for jobs than there are open positions.

If over that time the ratio falls only to the pre-pandemic rate of around 1.2, by contrast, inflation as measured by the Consumer Price Index would fall to around 2.7% - still high, but "within striking distance" of the Fed's 2% target, the authors said, given the differences between the CPI and the Personal Consumption Expenditures Price Index the Fed prefers.

But "allowing (the ratio) to remain near current levels does not bring inflation down in our projections. Indeed, because an extended period of inflation raises long-term inflation expectations, it leads to slowly increasing inflation," they wrote.

The current ratio is 1.6, down from a peak of around 2 last year.

"The portion of inflation which traces its origin to overheating of labor markets can only be reversed by policy actions that bring labor demand and supply into better balance," Bernanke and Blanchard concluded. "Labor market balance should ultimately be the primary concern for central banks attempting to maintain price stability."

(Reporting by Howard Schneider; Editing by Dan Burns and Paul Simao)