Everstone Capital Asia Pte is seeking $1 billion for its latest private equity fund for India and Southeast Asia, according to people familiar with the matter.

The Singapore-based firm that invests largely in India, has begun sounding out investors about the potential fundraise, the people said. The company plans to start a formal pitch early next year, said the people, who declined to be identified citing confidential information.

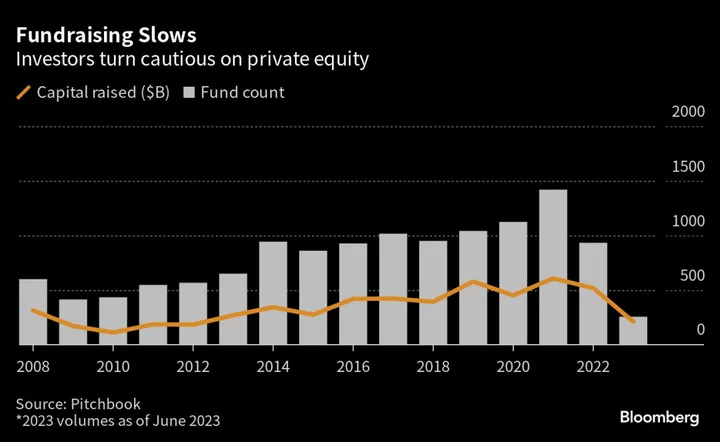

The new fund would be the largest ever for Everstone if it meets the target, even as private equity groups globally struggle to raise fresh funds amid soaring interest rates and slowing economic growth. Carlyle Group Inc.’s top executive said this week he was not pleased with the pace of fundraising this year.

India’s not immune to the slowdown, with just $1.7 billion raised by buyout and venture funds in the first seven months of this year, down from a record $8.5 billion in 2022, according to data from Preqin Ltd.

“So far, 2023 has been a tough year, with both deal-making and fundraising bearing the full brunt of these macroeconomic headwinds,” Preqin said in a recent report.

The new fund would be more than three times bigger than its predecessor fund, Everstone Capital Partners IV, which collected about $300 million last year, the people said. Everstone refers to the fourth fund as an “interim” or “bridge” fund as it waited for the macro-economic environment to improve for a larger fund, they said.

Everstone declined to comment on its fundraising plans.

The firm, started by former Goldman Sachs Group Inc. executives Sameer Sain and Atul Kapur in 2006, wrapped up its first fund with $425 million in 2006, followed by $580 million for a second fund in 2010 and $730 million for a third fund in 2016.

Investors in Everstone’s prior funds include International Finance Corp., the World Bank’s private-sector arm, which committed $60 million to the fourth fund.

Everstone pivoted from taking minority stakes in businesses to taking control of firms from its second fund. Since its third, the company has been following a “buy and build” model, which involves buying a mid-sized business and making acquisitions to help the business grow, the people said. The firm invests in digital tech services in India, along with healthcare, industrial, consumer and financial services companies.

Last year, the firm acquired Cprime Inc., a US digital technology consulting and solutions company, alongside Goldman Sachs Asset Management. It recently exited its stake in SJS Enterprises Ltd., an auto parts company in India.