China Evergrande Group, the world’s most indebted developer, got a final chance to get what could be the nation’s biggest ever restructuring back on track, as a Hong Kong court adjourned a winding-up hearing.

The decision was made by Judge Linda Chan in Hong Kong’s High Court on Monday to adjourn the hearing to Dec. 4, the latest in a series of delays since the proceedings began last year. “This is really the last adjournment,” Chan said. Evergrande shares, which trade as a penny stock, pared earlier losses of as much as 23% to 14% as of 10:35 a.m. in Hong Kong.

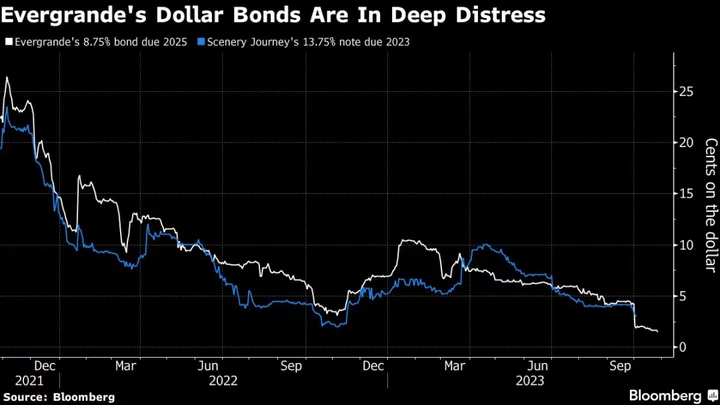

Liquidation risks rose recently after a shock from Evergrande late in September, when it scrapped creditor meetings at the last minute and said it must reassess its proposed restructuring plan. Any eventual winding-up would make Evergrande, with about 2.39 trillion yuan ($327 billion) of liabilities, the biggest Chinese developer to ever face such a fate.

Evergrande’s reassessment of its proposed restructuring plan prompted an ad-hoc group of creditors—who hold more than $6 billion of the builder’s about $19 billion of offshore notes—to say they were “left in the dark.” Just days before the hearing, the bloc had yet to decide whether it would speak out against the winding-up request despite having done so previously.

Evergrande’s saga injects more uncertainty into China’s property debt crisis as it heads into its fourth year amid record defaults. The problems for the industry began in 2020 when authorities laid out “three red lines,” which set leverage benchmarks for builders if they wanted to borrow more money. By the end of the next year, Evergrande had defaulted.

The liquidation hearing originates from a wind-up lawsuit filed by a creditor, Top Shine Global Limited of Intershore Consult (Samoa) Ltd., who was a strategic investor in Evergrande’s online sales platform.

The Hong Kong court has issued at least three winding-up orders for Chinese developers since the nation’s property debt crisis began, despite thorny jurisdictional issues and China’s interest in keeping developers afloat to ensure home-buyers get the houses they’ve paid for.

The fate of the builder and even bigger peer Country Garden Holdings Co.—deemed in default for the first time in recent days—is of broader significance to an economy where the property market and related industries account for about 20% of gross domestic product.

As the real estate crisis came to threaten worse contagion, authorities have recently taken steps to fine tune policy including a broad relaxation of downpayment requirements for homes and cuts to some mortgage rates. But that hasn’t been enough to turn things around: Property investment contracted 9.1% in the first nine months of the year.

Any liquidation may not necessarily lead to an immediate suspension of Evergrande’s construction work, housing delivery and other activities. After any order, the court could appoint a liquidator, who would seize control from directors and management to make major business decisions and seek gains for creditors from existing assets.

That’s not an easy process in dealing with Chinese developers. Most Evergrande projects are operated by local units, which could be hard for the offshore liquidator to seize.

Still, the bondholder group said earlier this month that any liquidation would likely “lead to the uncontrolled collapse” of Evergrande, and a failure to obtain regulatory approval to proceed with restructuring would be “the end of the road for restructuring of Chinese companies.”

The builder has to present “concrete” restructuring progress to help avoid the once-unthinkable liquidation. Amid mounting pressure, Evergrande also held talks in recent days with some creditors who had previously opposed its plan.

Representatives of Evergrande told some investors about the discussions with the creditors who are part of the so-called “Class C” group. Details of the talks weren’t available.

Unlike the ad-hoc bloc which had previously offered support, the Class C group had been one of the major roadblocks to any restructuring, which would be among China’s biggest ever with implications for banks, trusts and millions of home owners. The group is the second-biggest creditor class overall with some $15 billion of claims. And it’s the larger of two groups that didn’t provide sufficient backing for Evergrande’s plan based on the builder’s latest public disclosures on the matter in April.

The winding-up lawsuit had been lingering in the court for almost 17 months after multiple delays.

Challenges for Evergrande have mounted on all fronts. Founder Hui Ka Yan has been suspected of committing crimes and placed under police control, the company said in late September. Once Asia’s second-richest man and worth $42 billion at his peak in 2017, Hui’s net worth has tumbled to about $970 million.

(Adds more details)