China Evergrande Group delayed creditor meetings on its offshore-debt restructuring proposal just hours before they were to occur Monday, adding to uncertainty in a protracted process to finalize one of the country’s biggest restructurings ever.

The distressed developer delayed the meetings for the group and some units to Sept. 25-26, it said in a filing to the Hong Kong exchange. It cited a desire to let creditors “consider, understand and evaluate” the terms of the so-called schemes and allow them additional time to consider the company’s recent developments, including resumption of trading in its shares on Monday.

Creditors had been slated to meet Monday evening Beijing time at the offices of law firms Sidley Austin LLP in Hong Kong and Maples & Calder in the British Virgin Islands to cast their votes on the defaulter’s offshore debt restructuring plan.

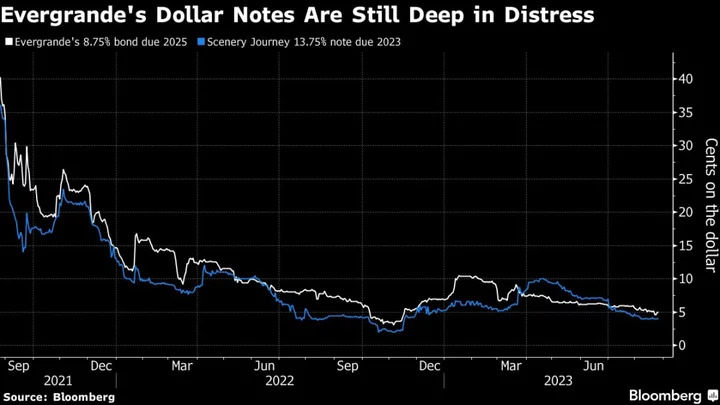

Any approval of the proposal, which emerged in March, would finally set in motion debt restructuring for a company still at the epicenter of a property crisis that has unleashed record waves of delinquencies and threatens to destabilize a creaky financial system. Failure to secure it would likely prolong creditors’ angst as the wait for a solution drags on, 20 months after Evergrande’s first public bond default.

The builder resumed stock trading on Monday, ending a 17-month halt. The company, which is undergoing a lengthy debt restructuring process, reported a loss attributable to shareholders of 33 billion yuan ($4.5 billion) for the six months ended June 30, according to a filing to the Hong Kong stock exchange Sunday.

Evergrande sought Chapter 15 bankruptcy protection in New York, a move that if granted would protect it from creditors in the US while it works on a restructuring deal elsewhere.

Evergrande received court approval to hold votes on its offshore debt restructuring plan in July, with the so-called scheme meetings originally scheduled for last week.

The gatherings had previously been pushed back several days, which the builder said was to give creditors time to consider the implications of a stock sale by the developer’s electric-vehicle unit. Based on March’s road map, Evergrande creditors can receive new notes maturing in 10 to 12 years or a combination of new debt and instruments tied to the shares of the automaker, the developer’s property-services unit or the builder itself.

Evergrande disclosed in April that more than 77% of Class A creditors, which account for $17 billion of claims and includes an ad-hoc group of bondholders, had acceded to a restructuring support agreement. The figure among Class C creditors that entail nearly $15 billion of claims and include margin loans and repurchase obligations was “more than 30%.” That’s short of the 75% needed from each creditor group to implement a restructuring through schemes of arrangement.

At a court hearing in July, an Evergrande lawyer said the developer prepared fresh information for creditors, including a recovery analysis done by Deloitte. Average recovery for Evergrande notes would be 22.5%, versus 3.4% if the firm gets liquidated, he added.

--With assistance from Emma Dong and Dorothy Ma.

(Retops)