The diverging fortunes of the two most prominent electric vehicle startups in the US show Wall Street is picking a side — and it’s not Lucid Group Inc.

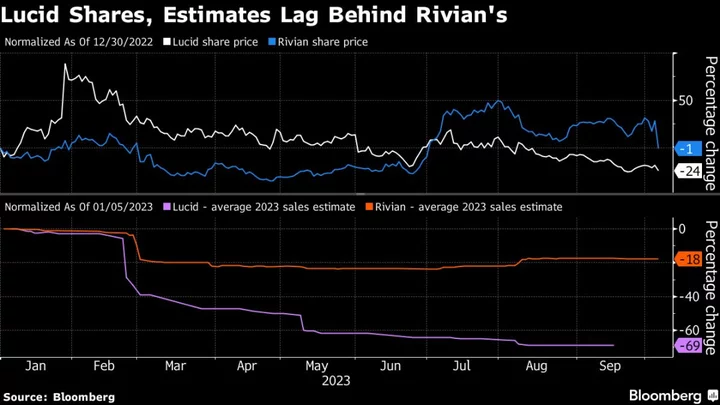

Having recently touched an all-time low, the stock is down nearly 25% this year, compared to a 1% decline for pickup truck-making peer Rivian Automotive Inc. in the same period. The percentage of bullish analyst ratings on Lucid has dwindled to only about a quarter of all recommendations. For Rivian, more than half of the ratings are the equivalent of a buy.

The performances reflect deeper differences. Lucid, which according to a Bloomberg Intelligence estimate is set to burn $338,000 for every vehicle it makes this year, said in August that it still expected to produce at least 10,000 cars in 2023. Analysts’ average 2023 sales estimate for the firm has sunk nearly 50% over the past 6 months.

In comparison, Rivian, which is estimated to lose about $110,000 per vehicle according to Bloomberg Intelligence, forecast full-year production of 52,000 units on Monday, and the average expectation for its 2023 sales has risen about 5%.

“Lucid is well below the pace needed to hit even 10,000 cars this years, and that’s why they continue to bleed money,” Jerry Braakman, chief investment officer at First American Trust, said in an interview. “The stock will continue to be challenged until they can show that they have made a significant progress in the number of units sold.”

Car making is a notoriously capital-intensive process. Which is why Lucid and Rivian’s deep-pocketed backers — Saudi Arabia’s Public Investment Fund for Lucid and Amazon.com Inc. for Rivian — helped them command premium valuations that they still enjoy over other upstarts. But that only goes so far at a time when markets are grappling with the prospect of higher-for-longer interest rates and tighter liquidity. Rivian shares slumped 23% Thursday after the company said it planned to issue $1.5 billion in convertible debt.

Lucid had tapped the capital markets for cash earlier this year, securing an infusion from the Saudi fund, a move that typically does not sit well with shareholders. “It dilutes the stock, so from a common investor’s standpoint that is a tough space to be in,” Braakman added.

The company is currently in a quiet period ahead of its third-quarter earnings report, and did not comment for the story.

Once seen as the most credible competitors to Tesla Inc., Lucid and Rivian entered public markets in mid-to-late 2021, when market enthusiasm for new EV-makers were high. Their valuations soared before the tables rapidly turned in 2022 as traders veered from riskier growth investments. Lucid is down 91% from its peak, while Rivian has lost 89%.

Severe supply-chain shortages and surging prices of battery raw materials plagued them further, but troubles have stuck with Lucid this year. The company has struggled to ramp up sales, selling around 1,400 units in both the first and second quarter. For the third quarter, it is estimated to have sold about 2,100 cars. Rivian’s sales, on the other hand, have grown significantly every quarter so far this year.

The risk that Lucid may default on its debt payments is also climbing. According to Bloomberg Intelligence credit analyst Joel Levington, the company’s default risk is now at 16%, almost four times the median for global automotive manufacturers. “Lucid’s near-term strength is its cash balance of $5.2 billion, but its cash burn of almost $7 billion through 2024 tempers views,” Levington wrote in a note on Wednesday.

At the same time, the firm is trying to find a foothold in a market where Tesla already rules. The company makes a luxury electric sedan that competes with Tesla’s Model S, along with several new models rolled out by more established global carmakers such as Mercedes-Benz Group AG, BMW AG, and Volkswagen AG’s Porsche and Audi brands.

“The problem lies with how Lucid positioned itself — going after a luxury, smaller volume market, while Rivian is targeting a bigger addressable market,” said Tom Narayan, an analyst with RBC Capital Markets. That said, Narayan noted that “Rivian isn’t out of the woods either, though it is now in a better place compared to Lucid.”

Tech Chart of the Day

There was a time when the market values of both Rivian and Lucid eclipsed those of Detroit automakers Ford Motor Co. and General Motors Co. Now they’re worth less than half of those firms. As of last close, Ford led the pack with a value of nearly $48 billion, followed by GM at about $42 billion. Rivian is perched at $17 billion and Lucid is down at about $11 billion.

Top Tech Stories

- Tesla Inc. cut prices on its most popular cars in the US again, days after its third-quarter deliveries missed estimates.

- Elon Musk’s X Corp., giving bankers an update on efforts to reinvigorate growth, said that it’s testing three tiers of premium service, which would allow the company to charge customers different amounts depending on how many ads are shown.

- The US Securities and Exchange Commission is seeking to force Musk to testify as it investigates the billionaire’s purchases of Twitter shares ahead of his takeover of the social media platform.

- Taiwan Semiconductor Manufacturing Co.’s third quarter revenue slid less than projected as demand from artificial intelligence players helped offset sagging smartphone and laptop chip sales.

--With assistance from Subrat Patnaik.