European bond bulls are counting on slowing inflation to reinforce their view that a downturn is on the way.

Money managers at J.P. Morgan Private Bank, Blackrock Inc. and Baring Investment Services Ltd. say there’s a stronger case for buying European bonds as the economy weakens. They’ll be closely watching the inflation report on Tuesday, which is expected to show that price growth dropped to 3.1%, the lowest level in more than two years, according to economists surveyed by Bloomberg.

The European Central Bank boosted fixed-income investors by halting a 14-month tightening cycle last week and speculation is already mounting over just how soon it will have to deliver cuts.

“With each incoming data print, the case is strengthening for the ECB to turn incrementally dovish,” said Samuel Zief, head of global FX strategy at J.P. Morgan Private Bank. There’s a compelling backdrop to add European bonds across the curve as the notion that the ECB’s next move will be anything other than a cut “looks hard to believe,” he said.

Private-sector activity also delivered a fresh blow last week, suggesting the region may be in recession, with Germany standing out amid sluggish Chinese export demand. All this means that the chance of another ECB hike is minimal, according to money market traders.

Read More: ECB Presses Pause After Barrage of Hikes to Tame Inflation

They price in just 2 basis points of additional increases — which equates to less than a 10% probability of further tightening. In fact, money markets see the first full quarter-point cut by June and a total of about 80 basis points of cuts by year-2024.

Dovish Price Discovery

The return of core inflation back below 3% in the first quarter of 2024 can no longer be ruled out, said Viraj Patel, a senior strategist at Vanda Research. The core metric, which strips out more volatile elements like energy and food, is expected to be 4.2% this week, according to a Bloomberg survey. Adjusting to this idea may trigger “the next leg of dovish ECB price discovery,” he said.

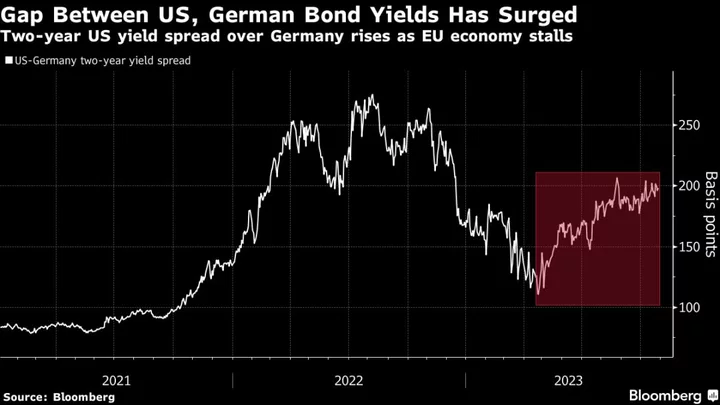

Patel reckons the yield spread between two-year Treasuries and equivalent German bonds can rise significantly north of current levels of around 200 basis points, if earlier and sharper ECB rate cuts are priced. The spread in 10-year yields has also risen sharply and last week traded at the highest level since early 2020.

Indeed, ECB President Christine Lagarde’s warnings over Europe’s economic outlook contrast with robust US data, where third-quarter growth came in at 4.9% — the fastest pace since 2021. Traders still see a one-in-three chance of another hike from the Federal Reserve by January.

“The Europe-US growth divergence continues to support overweight allocations in European sovereign bonds versus the US,” said Brian Mangwiro, a fund manager at Baring. “Weakening European growth and inflation outlook provides a better anchor for bond investors.”

Still, there are still plenty of reasons to remain cautious. Progress on inflation could be tested if the conflict in the Middle East escalates, pushing energy prices higher, and Lagarde herself last week reiterated it’s far too soon to contemplate rate cuts. One year inflation swaps jumped nearly 50 basis points in the fortnight following the Oct. 7 Hamas attack on Israel, though the move has since pared.

‘Tactically Overweight’

Others argue that the ECB’s 2% target is likely to prove elusive without additional cooling in the economy and labor market weakness.

Konstantin Veit, portfolio manager at bond giant Pacific Investment Management Co, says markets may in fact be overly optimistic regarding the proximity of rate cuts. The spillover from Treasury market weakness — the major driver behind the recent move higher in European yields — also remains a major headwind.

For Ann-Katrin Petersen, a senior investment strategist at the BlackRock Investment Institute, the bar for an ECB rate cut is higher than for another hike. Still, Lagarde’s efforts to downplay the prospect of tighter balance sheet policies — such as reducing bond holdings at a faster pace — bolsters the lure of high-quality government debt, she said.

“As market pricing reflects ECB policy rates staying high for longer, even as growth deteriorates, we are tactically overweight longer-term euro area government bonds,” she said.

--With assistance from Naomi Tajitsu, Anchalee Worrachate and James Hirai.