European stocks steadied after this week’s losses on signs of economic recovery in Germany while investors await the US monthly labor report.

The Stoxx Europe 600 edged 0.2% higher by 9:31 a.m. in London though it’s still headed for the worst week since early July. Oil stocks rose with crude prices while WPP Plc was among the biggest laggards after it cut its revenue guidance for the full year citing lower sales in the US from technology clients.

Flutter Entertainment Plc was leading the gains in the travel & leisure index after US peer DraftKings Inc. posted a sales beat and it raised its forecast for the year. Credit Agricole SA rose after the regional-bank holders are planning to increase their stake as the company reported a surge in profit for the second-quarter.

The closely watched US jobs report is another market catalyst to watch on Friday, which is projected to show employers boosted payrolls by 200,000 in July, while unemployment held at a historically low 3.6% and hourly pay cooled.

Meanwhile in Germany, factory orders unexpectedly jumped the most in three years in June, a sign that Europe’s largest economy is stabilizing.

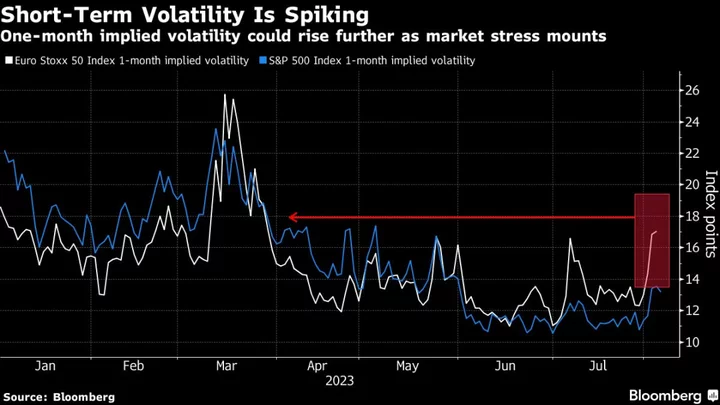

The start of August has been tumultuous for equity markets as bond yields surged after the US government ramped up its debt issuance to help finance a surge in budget deficits so alarming it prompted Fitch Ratings to cut the government’s AAA credit rating. As a more cyclical market, European stocks are showing more stress than the US, with one-month implied volatility on the Euro Stoxx 50 spiking to its highest level since March.

“US employment data will be important. In his press conference, Fed Chair Powell reiterated the importance of labor and inflation data. A strong US labor report could push bond yields further up which would be a headwind to a strong rally,” said Rajeev De Mello, a global macro portfolio manager at Gama Asset Management SA. “A weak labor number would remove some of the recent bond induced stress.”

SECTORS IN FOCUS

- Airlines and other travel-linked stocks after Booking reported second-quarter revenue that beat analysts’ estimates, reflecting strong demand for travel despite higher prices for flights and accommodations

- European stocks exposed to Apple after the iPhone maker posted its third straight quarter of declining sales and predicted a similar performance in the current period, hurt by an industrywide slump that has sapped demand for phones, computers and tablets

For more on equity markets:

- Market Volatility Awakens Ahead of Risk Events: Taking Stock

- M&A Watch Europe: Credit Agricole, GAM, Lookers, Fortum, Sika

- No Summer Lull for Mideast IPOs as Pipeline Builds Up: ECM Watch

- US Stock Futures Gain on Upbeat Amazon Earnings Before Jobs Data

- Next Fashion Fans Defy Soggy Summer: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika.