European stocks were subdued on Monday as investors braced for the busiest week of the earnings season and key central bank policy meetings.

Madrid’s IBEX Index fell 0.6% after an inconclusive election outcome. The Stoxx 600 was up less than 0.1% by 9:36 a.m. in London, with consumer products and retailers underperforming. Telecoms and real estate stocks gained.

“Uncertainty is weighing on Spanish stocks today as it looks as we will not have a stable government for a time after yesterday’s election in a downside context for the economy and with corporates facing higher pressures,” said Ricardo Gil, head of asset allocation at Trea Asset Management.

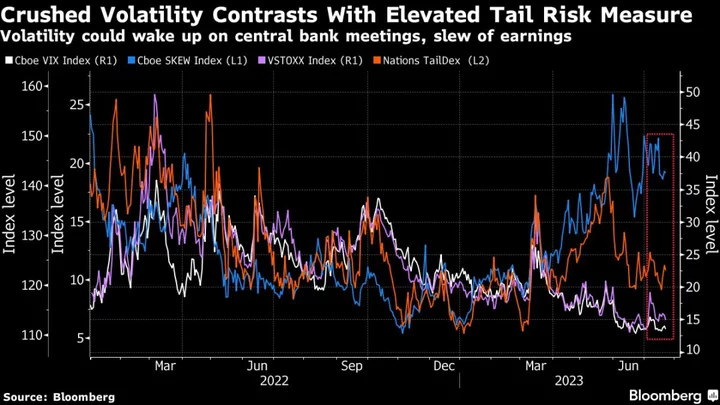

A rally in European stocks has lost steam this month amid worries about central banks remaining hawkish for longer. Investors will hear from the Federal Reserve and European Central Bank this week, with both central banks expected to raise rates by 25 basis points. Focus will remain on any clues about further rate hikes as US inflation slows while the labor market remains resilient.

“We expect markets to remain in a holding pattern until mid-week when the Fed and then the ECB publish their rate decisions,” Joachim Klement, head of strategy, accounting and sustainability at Liberum Capital. “We think the central banks will hint at an end to their rate hikes, which should support markets significantly.”

Meanwhile, the second-quarter earnings season kicks into high gear this week as Stoxx 600 companies with a combined market capitalization of $6.8 trillion are scheduled to report results, according to data compiled by Bloomberg. JPMorgan Chase & Co. strategists said they expect firms to beat the low bar for the quarter, but guidance might be tougher to raise given a loss of momentum and disappointing China dataflow.

Growth worries are also increasing, as data showed the euro-area private-sector economy contracted more than anticipated in July, with order inflows and output expectations pointing to the downturn deepening in the coming months.

Among individual movers, Ryanair Holdings Plc dropped as it cautioned that delays from new Boeing Co. aircraft will weigh on traffic growth in the coming year. Vodafone Group Plc rallied as it reported first-quarter service revenue growth that beat analysts’ expectations.

SECTORS IN FOCUS:

- Spanish equities after Prime Minister Pedro Sanchez engineered a late swing during the final days of the Spanish election campaign to deny his right-wing opponents a majority in parliament.

For more on equity markets:

- Buckle Up for Volatile Week of Central-Bank Action: Taking Stock

- M&A Watch Europe: SoftwareOne, Restaurant Group, GAM, Liontrust

- US Stock Futures Unchanged

- Ad Firm S4 Slashes Goals Over Wary Tech Clients: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika and Daniel Curtis.

Author: Sagarika Jaisinghani and Macarena Muñoz