European natural gas prices slumped following a brief rebound earlier this week, as unusual October warmth and lackluster demand outweigh concerns about supply risks.

Benchmark futures settled 5.8% lower, while day-ahead prices plummeted 16%. Temperatures in northwest Europe remain above seasonal norms, delaying gas needs for heating. This weekend will bring temperatures as high as 27C (81F) in some UK areas and close to that level in Paris, according to forecasters.

Weather predictions for the second half of this month keep changing, but some models are now pointing to prolonged mild conditions. Fuel shipments from Norway — the region’s top gas supplier — have risen to the highest level since late August after protracted outages, even though some seasonal works continue to face delays.

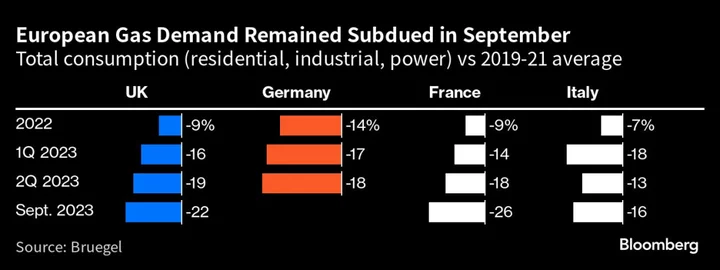

Europe is heading into the winter season on relatively safe footing, with storage facilities nearly full. At the same time, gas consumption is historically low, after severe cuts in demand at the peak of last year’s energy crisis. Overall fuel usage in France in September was 26% below the 2019-2021 average, while in the UK that drop was 22%, data published this week by think tank Bruegel show.

Dutch front-month gas, Europe’s benchmark closed at €36.21 a megawatt-hour, erasing Wednesday’s gains. The UK equivalent contract dropped 6.3%.

Potential Risks

Traders are closely monitoring the winter outlook for clues about demand. Under a “soft winter scenario” — likely characterized by mild weather and ample fuel supplies — European gas prices could drop even lower, according to Goldman Sachs Group Inc.

However, if the market tightens during the heating season, prices could rally toward levels where it becomes cheaper for some users to switch to oil, which is currently around €105 a megawatt-hour, analysts Samantha Dart and Daniel Moreno said in a note.

In addition, supply risks are lingering from a labor dispute in Australia that roiled the market in recent months. The country’s liquefied natural gas workers met Thursday after raising complaints over the terms of a deal to end strikes at Chevron Corp. facilities.