European natural gas halted its decline, after trading near the lowest level since July 2021, highlighting the uncertain outlook for demand as the region fills up its inventories ahead of next winter.

Benchmark next-month futures fluctuated, after falling below €36 a megawatt-hour on Monday. Prices have more than halved since the start of this year amid stable supply, mild weather and stronger contributions to power generation from renewables.

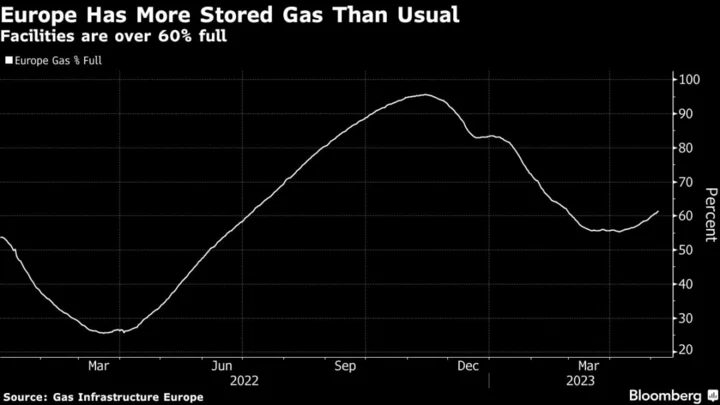

After Russia’s invasion of Ukraine caused energy prices to skyrocket last summer, Europe has seen a much calmer start to 2023, with imports of liquefied natural gas from across the globe making up for large amounts of curtailed supplies from Russia. Inventories in the region are now more than 60% full — some 20 percentage points higher than the average of the last five years — after a month of net injections.

Still, some analysts have warned that the slide in costs could spur greater consumption, as well as competition from Asian buyers. For now, there have been little signs of such trends taking hold.

“This is a unique period where it appears that the main demand centers of Europe and East Asia are already well supplied going into the summer, which lays a strong foundation for building up storages going into the winter,” said Lu Ming Pang, an analyst at Rystad Energy AS.

Natural gas purchases remain slower than usual for this time of year despite declining costs, suggesting that some buyers expect prices may continue to slide, and are holding off for now on restocking inventories. Still, analysts from Goldman Sachs Group Inc. to Boston Group Consulting have warned of the possibility of a price rebound above €100 if there’s a rapid pick-up in consumption and Asian demand.

Dutch futures were up 2.1% at €37.35 a megawatt-hour at 5:43 p.m. in Amsterdam. German next-month electricity was also higher, trading at €94.50 per megawatt-hour.

--With assistance from Eamon Akil Farhat.