Luxury-goods stocks slumped in Europe after Richemont Chairman Johann Rupert said inflation is starting to dent demand across the region.

Behemoth LVMH, recently dethroned by drugmaker Novo Nordisk A/S as Europe’s largest company, fell as much as 3.8%. That reduced its market capitalization below $400 billion, far from a peak of more than $500 billion reached earlier this year.

Richemont, the Swiss owner of Cartier and watchmakers including IWC and Vacheron Constantin, dropped 3.6% and Moncler SpA declined 4.1%.

“We’ve seen the squeeze,” Rupert, the leader and controlling shareholder of Richemont, told shareholders at the company’s annual meeting in Geneva on Wednesday.

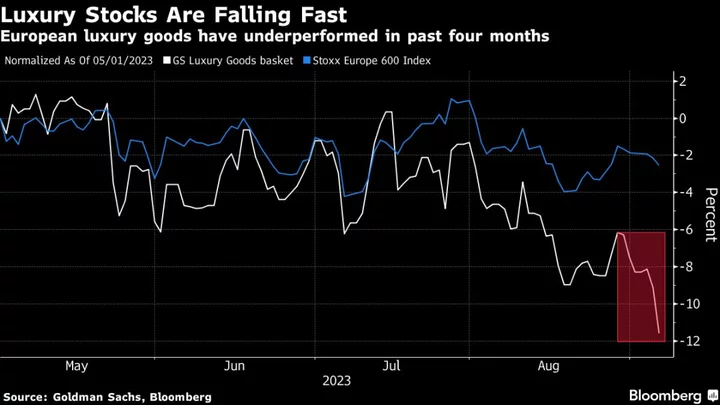

It’s a fresh setback for a sector that has been under pressure over the last few weeks on persistent worries about the economic slowdown in China, which accounts for about a fifth of their revenue. That also adds to a reversal in the sales boom when economies started coming out of the pandemic as shoppers, helped by low interest rates and pent-up savings, splurged on pricey goods.

Also on Wednesday, HSBC Holdings Plc published a note cutting estimates and price targets across the luxury space. Analyst Erwan Rambourg attributed the changes to the impact of a recovering euro and a higher cost of growth for the industry in the short term.