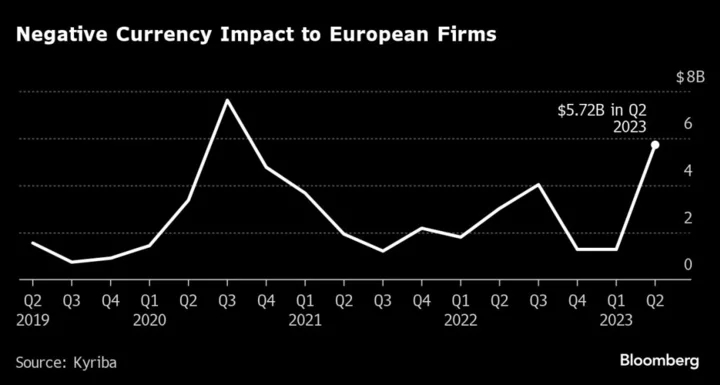

European multinationals doing business abroad suffered the biggest hit to earnings from currency volatility in nearly three years, forcing corporate treasurers to be more vigilant in their hedging strategies.

The negative impact to European corporate profits totaled $5.72 billion between April and June, more than four times the $1.28 billion in the prior quarter, according to a report by Kyriba Corp. That’s also the highest total since the outbreak of the pandemic rippled through markets in 2020, data from the corporate-treasury management company showed.

Companies have had to grapple with one of the most complicated hedging environments in recent memory. As central banks neared the end of their easing cycles, financial markets were upended by the turmoil of the March banking crisis that bled into the second quarter, derailing big bets on recessions, a weaker dollar and a bond rally.

“What you’re seeing is the movement of the currency storm into Europe,” Andy Gage, Kyriba’s senior vice president of FX solutions, said in an interview. “We’ll see more currency pressures in Europe going into next year. Everybody needs to be extra vigilant.”

Read more: Corporate Giants Are the New Hedge Funds of the Global FX Market

Among European corporations, the euro was the most frequently-mentioned currency during quarterly earnings calls, Kyriba found, followed by the dollar and the Swedish krona. Machinery, trading, and distribution firms were the most impacted sectors, according to the report.

As a result of the sustained headwinds from currency fluctuations, companies are rethinking hedging strategies, Gage said.

“People are trying to be more intelligent about how they’re thinking about hedging — more risk-based, cost-of-carry based analysis,” Gage said. “They’re being smarter and more selective about the hedges they’re putting on.”

- Among North American firms, a subdued dollar softened the impact to corporate profits in the second quarter, with companies reporting $14.4 billion in negative headwinds, down from $21.2 billion in the first quarter.

- In the second quarter, the Canadian dollar’s best three-month run since the end of 2020 weighed on corporate earnings; the loonie supplanted the euro as the most-frequently mentioned currency on North American earnings calls.

- Overall, among both North American and European firms, total FX headwinds amounted to $20.2 billion in the second quarter, down 10.5% from the prior period.

- The firm’s analysis is based on earnings calls of 1,700 publicly traded North American and European companies doing business in more than one currency and with at least 15% of revenue coming from overseas.