European natural gas prices fluctuated between gains and losses on Wednesday as traders weighed rising storage levels and increased flows from top producer Norway against the impact of extreme heat in southern parts of the continent.

Benchmark futures rose as much as 4.2% after earlier declines, extending the week’s gains. The moves suggest that extreme temperatures in parts of continent continue to test the market’s ability to cope with higher demand, even though supply risks appear to be contained for now.

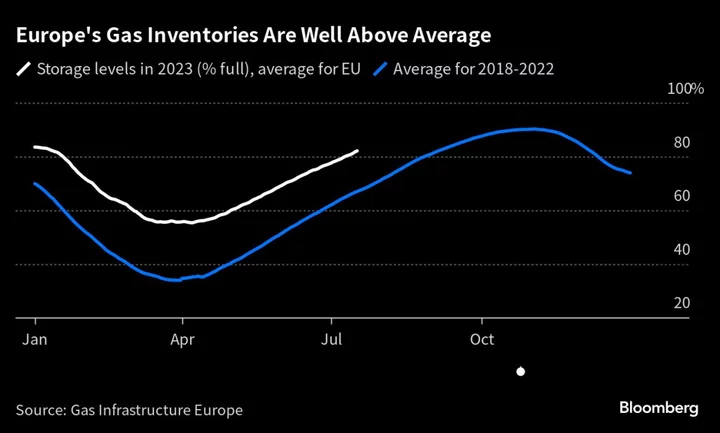

Europe has emerged from the worst of last year’s crisis with ample gas storage levels, providing a sense of security that it will manage to restock enough fuel ahead of next winter. Facilities are already 82% full, well above the seasonal average, while natural gas supplies from Norway continue to edge higher.

Still, the extreme heat has triggered wildfires from Greece to Switzerland, while Rome and Spain’s Catalonia region recorded their highest-ever temperatures, driving up demand for fuel to power cooling needs.

In Italy, for example, electricity consumption has shot up, with the country’s seven-day rolling average power use at the highest since 2017 on Tuesday, according to Bloomberg calculations based on available data from power grid operator Terna SpA. Traditional thermal power plants contributed to more than half of the day’s actual generation, the data show.

Both Spanish and Italian day-ahead gas prices are trading at a premium to the Dutch counterpart. Even though the worst of the heat is in the south, gas purchases are also increasing in the UK, where temperatures are below average for the season. Total demand there is shooting up to levels last seen in May, grid data show.

The European market remains tight, with prices likely to continue reacting to news on rising demand or unplanned curtailments of supply, according to the Oxford Institute of Energy Studies.

“Looking at the months ahead, it is not difficult to paint a picture of a further dip in prices should European storage be full by early September followed by a sharp upward spike if the winter starts with cold weather,” James Henderson, the institute’s head of gas research, wrote in a quarterly gas review. “As such, volatility is likely to remain the main feature of the market during the rest of 2023.”

Dutch front-month gas, the European benchmark, rose 3.3% to €27.98 megawatt-hour by 3:09 p.m. in Amsterdam. The UK equivalent also traded higher.

--With assistance from Elena Mazneva.