European natural gas prices declined further to the lowest level in nearly two years as demand prospects for the region remain bleak.

Benchmark futures fell as much as 2.1% after earlier gains on Wednesday. Weak industrial demand and fuller-than-usual gas storage facilities have weighed on prices for several consecutive weeks, raising questions over how much lower they can drop before producers re-evaluate supply needs.

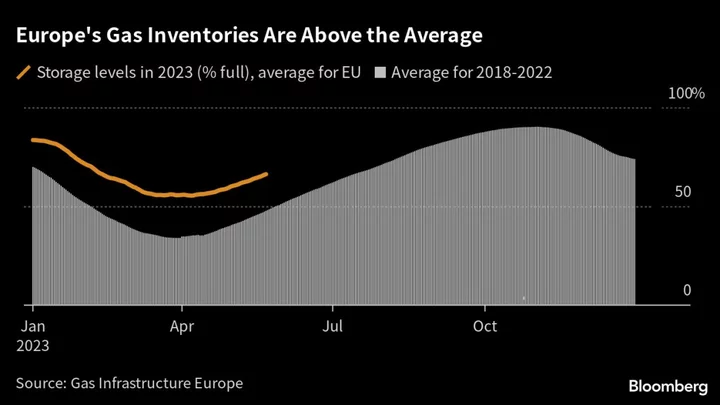

Europe is heading into the warmest months of the year with inventories about 66% full — well above the historical average — indicating that it has turned the page on the worst of the energy crisis. But with economic activity yet to make a meaningful recovery despite cheaper gas prices, there are some concerns that supply in the market could outstrip demand heading into later months — especially once storage-refilling efforts start to slow — potentially prompting curbs to output.

An index tracking euro-zone manufacturing activity shrank this month at the fastest pace since the pandemic shuttered factories three years ago, threatening to sap momentum from the overall economy. At the same time, the relative strength index — a technical indicator for how rapidly prices advance or drop — shows that gas futures have been oversold in recent days.

Traders are still eyeing the possibility of higher gas usage in the coming weeks if the weather turns hotter. That could mean higher fuel consumption to power air conditioning. Risks for the upcoming winter are also in focus.

“Moving forward, what happens in the winter months with prices will be key,” said Ole Sloth Hansen, head of commodities strategy at Saxo Bank A/S.

Dutch front-month gas, Europe’s benchmark, traded 1.3% lower at €28.78 per megawatt-hour at 10:22 a.m. in Amsterdam. The equivalent UK contract also declined.