Euro-zone inflation readings used to be poured over for clues about how much higher the European Central Bank would send interest rates. Now, though, the figures are set to shape bets on cuts.

The shift is down to the latest ECB hike, which — despite President Christine Lagarde’s protests — investors, economists and many of her colleagues reckon was the final leg of this historic ramp-up in borrowing costs.

The focus is now on keeping the deposit rate at 4% for an extended period. But investors are asking how long can it stay there in the face of a flat-lining economy and with politicians on the warpath over the hit to growth.

Markets are currently betting on a first rate cut next July. ECB officials haven’t been clear on their preferred timetable.

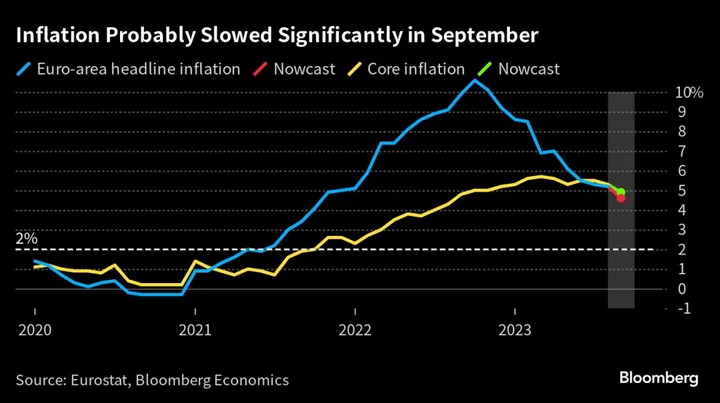

Inflation will determine how long peak rates persist — and Friday’s data for September will provide a first glimpse. As the ECB enters this new phase, an estimate of euro-area price gains by Bloomberg Economics’s new Nowcast model points to a steep slowdown — to 4.6% from 5.2% in August.

A gauge of underlying pressures that strips out energy and food costs will continue to garner attention, too — especially as the prospect of $100 oil looms. The Nowcast, which incorporates 32 variables ranging from unemployment to energy costs, sees core prices rising by 4.9%.

The median economist estimate suggests a similar slowdown, with 4.5% for the headline gauge and 4.8% for the core number.

Country data will be mixed: The Nowcast suggests Germany will report a substantial slowdown, while France and Spain see accelerations. Italy probably held at 5.5%.

What Bloomberg Economics Says...

“Euro-area headline and core inflation are likely to drop below 5% for the first time this year in September. That will ease pressure on the ECB and cement the case that interest rates have peaked in the region.”

—Maeva Cousin, senior euro-area economist. For more, click here

As well as the ECB, inflation dynamics may be entering a new phase. After a summer during which both the headline and underlying measures fell only marginally — blame German transport subsidies for that — analysts now anticipate a more rapid retreat.

Weaker economic growth could slow price gains further still. Data Monday showed only a marginal improvement in the business outlook in Germany, with Clemens Fuest, who heads the Ifo institute that compiles the numbers, saying sentiment “remains bleak.”

The last mile of inflation’s return to the 2% target may well be the toughest and is unlikely to be as rapid as this month’s reading may suggest. The ECB still sees price growth averaging 3.2% next year and only reaching its goal in 2025.

Slovak central bank chief Peter Kazimir has warned that officials won’t be able to sound the all-clear until they see quarterly forecasts next March. “It remains open and unanswered how long it will be necessary to stay with rates at peak levels,” he said.

Others on the 26-strong Governing Council caution that further tightening may yet be necessary should prices not recede as envisaged.

“Have we reached the plateau?” Bundesbank President Joachim Nagel said. “This can’t yet be clearly predicted. The inflation rate is still too high. And the forecasts still only show a slow decline.”

Most, though, think rates are now at their high point. Bank of France Governor Francois Villeroy de Galhau said Monday that “we should now focus on the persistence of policy rather than the constant pushing of rates higher — duration rather than level.”

And despite Lagarde saying the ECB hasn’t “decided, discussed or even pronounced cuts,” some policymakers are starting to say the word out loud.

“As things stand, I assume that our next step will be an interest-rate cut,” Greece’s Yannis Stournaras told the Boersen-Zeitung newspaper last week. “I think we have reached the interest-rate peak. That is my feeling and my understanding.”

Note: Bloomberg Economics’ Nowcast models provide a high-frequency data-driven forecast of key economic variables ahead of their official release. They also show how different inputs impact the forecast. All of the Nowcast models are Bayesian Vector Autoregressions (BVARs), a well-established modeling framework. They include the main market-moving indicators for each variable of interest and are updated daily.

--With assistance from James Hirai, Joel Rinneby and Andrej Sokol (Economist).

(Updates with Ifo, Villeroy starting in 10th paragraph.)