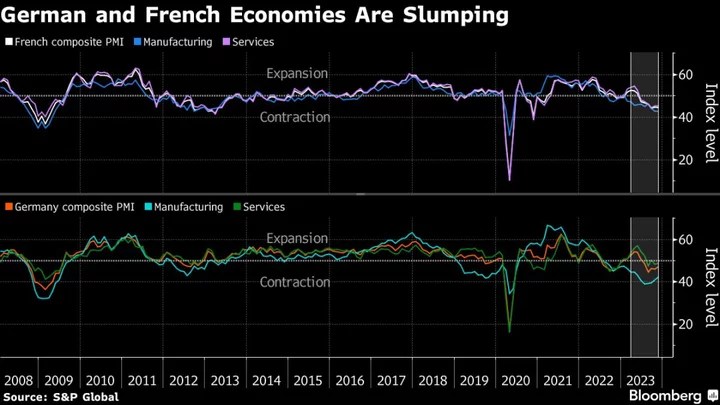

A recession in the euro area is looking increasingly likely as the economic downturn persists in the final quarter of the year, private-sector activity surveys showed.

S&P Global’s purchasing managers’ index was in contraction again in November, hitting 47.1. While that’s a bigger uptick than anticipated by economists, it marks the sixth consecutive month below the 50 level that marks expansion. Readings for both manufacturing and services showed a similar trend.

“The euro-zone economy is stuck in the mud,” Hamburg Commercial Bank Chief Economist Cyrus de la Rubia said, adding that the latest figures indicate “the potential for a second consecutive quarter of shrinking GDP.”

That suggestion of a contraction — following a 0.1% retreat in gross domestic product in the three months through September — contrasts with the European Commission’s forecast for a return to growth and analysts’ expectations for stagnation this quarter.

Still, it chimes with European Central Bank Vice President Luis de Guindos’s warning that markets may not be fully pricing in the risk of a stronger hit to the euro-zone economy following a year of interest-rate hikes and rising political tensions.

“The outlook that markets are taking with respect to the evolution of the economy, I would say it is a little bit sanguine and optimistic,” Guindos told Bloomberg Television on Wednesday. “There is a little bit of wishful thinking.”

The region’s top two economies find themselves in “the grip of considerable weakness,” according to de la Rubia, though German PMI data for November put it slightly ahead of France.

Germany’s contraction eased in November in a signal that growth will return to the euro area’s biggest economy after a likely recession this year.

Private-sector activity declined at a slower rate than in the previous month and less than economists had expected, according to S&P Global. Both manufacturing and services saw improved conditions, with new orders falling more moderately.

“Despite remaining in recession territory, the rate of slowdown has eased noticeably,” Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said in a statement. There’s “growing confidence that a return to growth territory is a plausible prospect, potentially materializing by the first half of the upcoming year.”

Germany’s 10-year yield rose as much as 3 basis points after the data were released to the day’s high of 2.59%. French bonds were little changed. The euro is trading 0.3% higher at $1.0921 amid broad dollar weakness, close to its highest levels over the past three months.

“The positive PMI surprise out of Germany could help offset some of the negative surprise from the French PMI,” said Valentin Marinov, head of G-10 currency strategy at Credit Agricole SA. While the impact on the euro may be muted today, the data “could still pave the way to some consolidation, especially if tomorrow the German Ifo confirms that the worst of the economic downturn is behind us.”

With the fifth consecutive monthly contraction, the data still suggest a recession in the six months through December will be difficult to avoid. The Bundesbank said this week that output will only start to expand next year as household incomes recover and things look better in the country’s important industrial sector.

PMIs are closely watched by markets as they arrive early in the month and are good at revealing trends and turning points in an economy. A measure of breadth of changes in output rather than depth, business surveys can sometimes be difficult to map directly to quarterly GDP.

French activity remained on a steady downward path this month. S&P Global’s purchasing manager index was little changed at 44.5.

“The French economy is kind of in a dead-end,” according to Norman Liebke, an economist at Hamburg Commercial Bank. “It looks as if geopolitical and economic uncertainty played a major role here, as this was mentioned by some companies as reason for the lack of new orders.”

Manufacturing and services in the euro zone’s second-biggest economy equally suffered from weak demand. With unused business capacity on the rise, the data pointed to the first decline in private-sector employment in three years.

Inflation remained an issue in France and Germany, with services companies blaming rising wages for pushing up input prices, and output charges still increasing.

“The outlook suggests that inflation is unlikely to experience a significant decrease in the coming months,” de la Rubia said.

Earlier PMI numbers from Australia pointed to a deeper slump. UK figures are expected to indicate a stable downturn. US data won’t be published until Friday due to the Thanksgiving holiday and are expected to show slight expansion.

--With assistance from Joel Rinneby, Mark Evans, Jamie Rush (Economist) and Alice Gledhill.