The European Union’s sanctions against Russia will build over time and will have a growing long-term impact on Moscow’s economy, according to the bloc’s executive arm.

An impact assessment prepared by the European Commission and seen by Bloomberg outlines the effects on Moscow due to the bloc’s sanctions, which have cut off around €91 billion ($99.1 billion) in imports from Russia and which cover €48 billion of EU exports.

The sanctions have “significantly degraded Russia’s industrial and technological capacity,” according to the report. “These effects will further intensify over time, as the measures have a structural, long-term impact on Russia’s budget, financial markets, foreign investment and its industrial and technological base.”

The EU has sanctioned almost 1,500 people and 250 entities since Russia’s attacks on Ukraine, starting with its annexation of Crimea in 2014 and followed by its invasion of Ukraine in February last year. With the the measures designed to minimize the effects on member states, the impact on the EU has been contained but it has been “tangible” in some areas mostly due to Russia’s counter-measures and because of the war itself, and the resulting rise in prices, according to the document.

The assessment notes that European industry has reported a few “severe” import-related supply chain disruptions on rare gases such as neon and xenon that are used to produce chips. Rail freight between the EU and China transiting via Russia has fallen and the import ban on wood products as well as Russian countermeasures has contributed to price increases and some supply issues, especially for plywood and oak.

EU exports to and imports from Russia have fallen by more than 50% compared to 2021 resulting in “an unprecedented decoupling,” the assessment says. This has led to technology-dependent processing industries to shrink particularly fast, with high and medium-high technology manufacturing recording a 13% annual loss.

For exports of dual-use items and advanced technology the fall is particularly steep, dropping 78% in 2022 compared to 2019-2021.

Still, Moscow has been able to hoard some materials as well as source some banned goods and other substitute technologies from third countries including China, Kazakhstan, Turkey and the United Arab Emirates.

The assessment notes that China has been exporting record volumes of some goods. It questions, however, Moscow’s ability to easily source key items noting that the measures “are designed to target key capital and intermediate goods where Russia’s dependency on supplies from the EU, United Kingdom, United States and Japan is over 60% and where China currently supplies less than 25% (i.e. areas where Chinese businesses have limited capacity to fill the gaps).”

That is why much of the EU’s most recent efforts have been focused on enforcing restrictions and cracking down on Russia’s ability to get around sanctions, including through third countries.

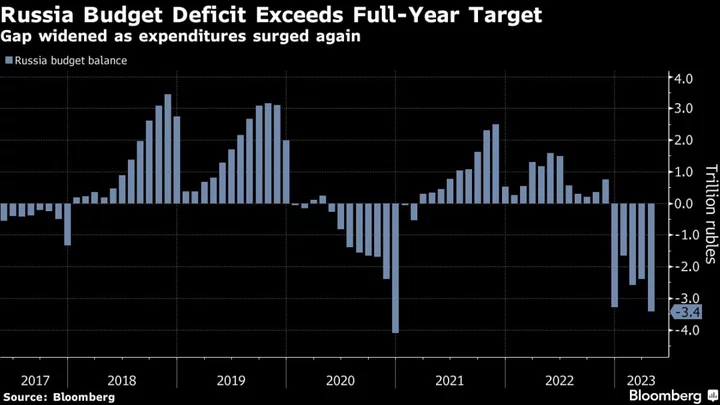

The report estimates that nearly a third of Russia’s federal budget will be spent on defense and domestic security this year. Russian steel production was down 7% last year compared to 2021 and a further 10% drop is expected this year.

“Far beyond their immediate impact, the EU’s import restrictions filter deeply into the fabric of Russia’s economy,” according to the document.

What Bloomberg Economics Says...

“Sanctions, and the cost of the war effort, will have a slow-burning impact on Russia’s long-term growth prospects. Broken connections with the rest of the world mean inefficient local firms gain a stranglehold on the domestic market, denting productivity growth.”

—Alexander Isakov, Russia and CEE economist. For full note, click here

Meanwhile, the impact of measures introduced by the EU and its Group of Seven allies on Russia’s energy sector, including a price cap on oil, has been mixed.

Moscow has been able to divert some lost sales to countries such as China, India and Turkey but these have often commanded significant discounts of some $30 relative to the price of Brent, the assessment notes.

An export ban on oil refining and gas liquefaction technologies has made it impossible for Russia to upgrade its refineries to the necessary export standards, the document says.

While the vast majority of EU member states have been able to halt their imports of Russian oil and source supplies elsewhere, a few nations, including Hungary, Slovakia and the Czech Republic, continue to depend on Moscow’s crude.

A rise in commodity and energy prices following the beginning of the war has also been more severe in the EU compared to some of its allies, including the US and Japan, affecting the bloc’s competitiveness. Several member states have experienced periods of recession since early 2022.

As of the end of June, the commission has approved more than 250 national measures to mitigate the economic impact of the war for a total cost of around €730 billion.

Restrictions on Russian steel have not caused significant supply issues as goods have been mostly replaced with imports from other countries. Similarly, disruptions to imports of most critical raw materials – which are not sanctioned – have so far been avoided, with imports of aluminum, nickel, palladium and titanium all holding steady. The assessment notes that iron ore, where imports from Russia have fallen 85%, is a notable exception.

Still, the war itself has disrupted supply chains and caused some shortages in raw materials, and companies have had to find new routes at higher prices, the assessment acknowledges.

According to the report, the sanctions “have considerably limited Moscow’s political and economic options, caused financial strain, cut the country from key markets, increased the costs of trading and significantly degraded Russia’s industrial and technological capacity.”

(Updates with report details from the 13th paragraph.)