The European Union launched a wind power package on Tuesday to counter the growing influence of China and spur its own industry, as the bloc focuses more firmly on China as the biggest threat to its clean-tech industry.

The bloc’s panic earlier this year that it was about lose its clean-tech industry to the US, lured by its promise of huge tax credits and lack of red tape, has largely subsided. The EU is growing increasingly confident that few of its companies will abandon its shores in favor of President Joe Biden’s Inflation Reduction Act.

To defend the role of the EU’s industrial champions in the climate transition, the bloc now wants to make sure that Europe’s world-leading wind industry — companies like Siemens Energy AG and Vestas Wind Systems A/S — doesn’t suffer the same fate as the solar sector 10 years ago. The vast majority of solar panels are now made in China.

“We will not close our markets but we will take care of our security concerns,” said Kadri Simson, the EU’s energy commissioner.

In 2022, the EU’s trade balance with China in the wind sector showed a record negative deficit of €462 million ($492 million). Prices are on average 20% lower than those of both Europe and the US.

In its new plan, the EU’s executive arm pledged to prop up the bloc’s wind industry by looking to improve access to EU financing and speed up permitting. It also wants to overhaul the way countries conduct auctions to provide renewable energy so they take into account factors beyond cost, such as cyber-resilience and carbon content of new wind farms.

More broadly, the commission on Tuesday released its first assessment of the impact of the US clean-tech law, which found that the macroeconomic effect of its subsidies and tax breaks has so far been limited.

“While IRA may lead EU companies to consider relocation to the US, preliminary and available data are so far not conclusive,” the report concluded, adding that the measure’s provisions — along with cheaper US energy prices — are making the US a more attracting place to invest than before.

Fossil Fuels

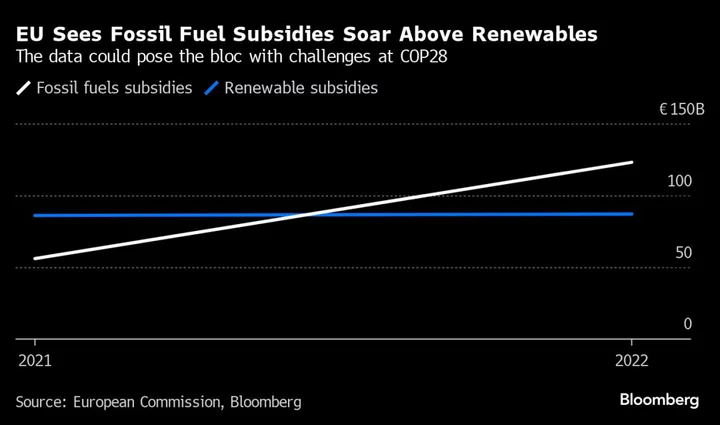

A separate report highlighted a worrying trend of surging subsidies for fossil fuels in the EU, jumping from €56 billion in 2021 to €123 billion in 2022 as the EU worked to ditch Russian supplies. Over the same time period, subsidies for renewables only marginally increased by €1 billion to €87 billion. Those figures stand in contrast to the EU’s position at COP28 next month — to phase out such support for oil, gas and coal.

Read more: EU Backs Off Date Ending Fossil Fuel Subsidies Before COP28

The EU’s news climate commissioner, Wopke Hoekstra, said the bloc is aiming to conduct an assessment of fossil fuel subsidies in the first quarter of next year.

“The commission encourages member states to phase out energy crisis related support,” Simson said. Such measures include direct support schemes or tax deductions for fuel.

Renewable Push

On the wind sector, the EU will also closely monitor unfair trade practices that benefit foreign manufacturers, including close scrutiny of potential subsidies for wind-related products imported into the 27-nation bloc.

The challenge is to make sure that the EU’s wind industry is robust enough to support its ambitious target to make renewables at least 42.5% of the energy mix by the end of the decade. The bloc’s State of the Energy Union report, also published Tuesday, showed that much faster growth in capacity is needed to reach those goals.

Measures in the plan include:

- Rolling out digitalisation of the permitting process across all member states and extension of an emergency regulation to accelerate permitting

- Establishing an interactive EU digital platform where member states’ planning for auctions will be published

- Overhauling auctions design to include a set of pre-qualification criteria relating to cyber-security, sustainability, and ability to deliver

- Identifying cybersecurity risks with respect to wind energy installations and infrastructure

- Expanding support for wind energy under the Innovation Fund by doubling the budget for financing clean technology manufacturing projects to €1.4 billion

- Working with the European Investment Bank to deploy by the end of the year a dedicated instrument to counter-guarantee commercial banks’ credit exposures to key wind industry suppliers

(Updates with asessment of US law starting in sixth paragraph)