The green finance targets of European banks are falling well short of what is needed, according to a fresh study by ShareAction.

An analysis by the UK-based nonprofit that examined the green finance claims of the 20 biggest lenders spread across the European Union, the UK, Switzerland and Norway found that “targets and disclosures aren’t fit for purpose and could lead to misleading claims.”

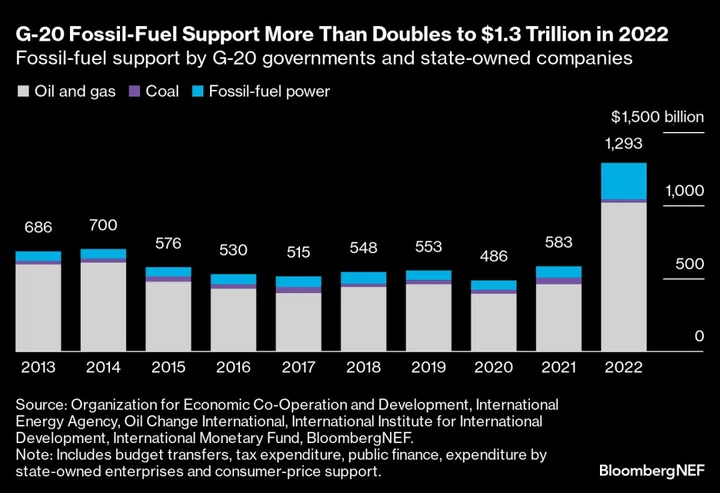

The findings coincide with increasingly gloomy predictions around the planet’s hopes of limiting global warming to the critical threshold of 1.5C. The United Nations estimates the world now has only a 14% chance of reaching that goal, as fossil fuels continue to enjoy access to financing that would otherwise be spent on green projects. At the current pace of emissions reductions, the average temperature is on track to rise 3C, the UN warned on Monday.

ShareAction is known for pushing climate-change resolutions at banks including HSBC Holdings Plc and Barclays Plc, nudging both lenders to pledge emissions cuts. Last year the nonprofit helped coordinate a shareholder vote at Credit Suisse, pressuring the bank — now part of UBS Group AG — to align its business with the 1.5C goal of the Paris climate agreement.

Criticism of banks’ green claims feeds into a wider debate around environmental, social and governance metrics, as investors and regulators grow increasingly wary of how the ESG label is being applied.

Against that backdrop, ShareAction found that the banks it looked at mostly have green finance targets that “fail to demonstrate” how the lenders will realistically achieve net zero emissions by 2050. The nonprofit also criticized the industry for failing to publish methodologies that explain the metrics on which green claims are based.

What’s more, most banks include products and services that shouldn’t rightly be defined as green financing, ShareAction said. “Banks don’t always disclose what activities count as green, and those that do consider certain controversial activities to be eligible,” the nonprofit said in its report.

Given the crucial role that banks can play in steering the global economy away from environmentally dangerous activities, ShareAction is recommending the industry adopt a list of practices to help stakeholders analyze the role played by the industry.

These include publishing a transparent methodology around green financing goals, and ensuring that these targets “only cover financing activities that result in the allocation or facilitation of capital by the bank,” ShareAction said.

Importantly, banks should be required to report the impact of their green financing activities, the nonprofit said. And the industry also should be required to disclose positions on green-related regulatory issues as well as membership of climate-related trade associations, ShareAction said.

Other Key Points:

- ShareAction says banks generally aren’t including capital markets activities in their green finance goals. Barclays represents a notable exception, with its application of a 33% weighting to its pro-rata so-called facilitated emissions.

- The analysis also focused on the lack of reporting on “impact” and “additionality.” Examples include UBS Group, which ShareAction notes says 93% of mortgages in its 2022 green funding allocation report stem from refinancing. Standard Chartered Plc says its sustainable finance asset base rose 45% between July 2021 and September 2022, largely due to the identification and tagging of $3.8 billion in so-called green mortgages. According to ShareAction, however, the “lack of reporting around impact and additionality makes it difficult to assess what banks’ green finance volumes truly achieve.”

- ShareAction also says that most banks it looked at include products and services that are unrelated to financing in their green targets. It lists Banco Bilbao Vizcaya Argentaria SA as an example, citing the bank’s €300 billion ($330 billion) 2025 sustainable-finance target that covers structured deposits. The nonprofit also singled out HSBC Holdings Plc’s 2030 target of between $750 billion to $1 trillion because it included asset management.

- According to ShareAction, “green finance targets should only cover financing activities that result in the allocation or facilitation of capital by the bank. These include lending, proprietary investment and capital markets facilitation.”

- Spokespeople for UBS, Barclays and StanChart declined to comment.

- A spokesperson for HSBC said it seeks “to apply market standards in providing sustainable finance and for identifying and reporting sustainable financing and investments towards our ambition in our annual disclosures.” The bank also said “supporting the transition to net zero, and engaging with clients to help them diversify and decarbonize is a key priority for to us.”

- A spokesperson for BBVA said the bank has “a very robust approach” to its sustainability standards, and referred to its framework for an explanation of why it includes structured deposits in its target. The bank reviews the portfolio quarterly and removes assets deemed no longer to be in compliance.

--With assistance from Natasha White.