The ESG fund with the biggest exposure to Nvidia Corp. has just beaten 99% of its peers, as bets on artificial intelligence transform the fortunes of portfolios promoting environmental, social and governance principles.

The $830 million Nvidia stake held by Swedbank Robur Technology C (Ticker: SWCONTU SS) makes it the most exposed ESG-registered fund to the world’s most valuable chip company, according to the latest data compiled by Bloomberg. That’s in a universe of about 1,300 ESG funds that hold Nvidia, the data show. The $10.5 billion Swedbank Robur fund gained 20% last month alone, topping 99% of peers. This year, it’s up 40%.

Kristofer Barrett, who manages the fund from Stockholm, says he’s been trying not to get dragged into the frenzy, because there’s plenty of evidence that markets can be “irrational.” The tech fund he oversees, which is registered as Article 8 in the EU, meaning it “promotes” ESG, has held Nvidia since 2016.

“Net-net, because of efficiency, productivity, things like that, AI is going to be good for society,” Barrett said.

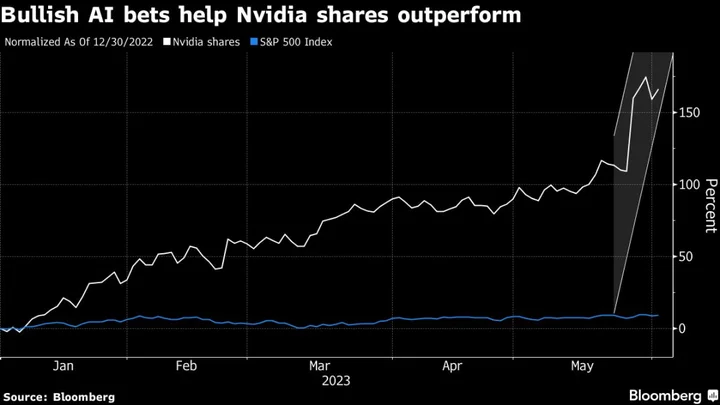

After adding almost a third to its value following a surprisingly strong revenue forecast last week, Nvidia fell 5.7% on Wednesday and then rebounded Thursday. Investors were reacting to other corners of the AI industry, where weaker-than-estimated numbers injected a sense of caution after days of breathless gains.

There will be “great opportunities both on the buying and selling side, while the fundamentals change much more slowly,” Barrett said in an interview. “As with everything, where valuations change, there are risks.”

The ESG fund industry has long had an outsize exposure to tech, which investors have treated as an easy path to low-CO2 portfolios. During the pandemic, that bet paid off as low interest rates and global work-from-home policies buoyed the sector. But last year, everything changed. Higher rates and an energy supply crisis caused by Russia’s unprovoked war against Ukraine made tech a losing bet, which fueled a polarizing debate around the future of ESG.

The Next Cycle

Now, the pendulum appears to be swinging yet again. The world’s best-performing ESG funds this year have all booked returns exceeding 30% and are packed full of tech, covering everything from long-standing giants such as Microsoft Corp., to newer names in renewables, artificial intelligence and semiconductors, according to data compiled by Bloomberg.

In fact, tech is by far the biggest sector in so-called Article 9 funds, the EU’s top ESG designation, according to an analysis by Bloomberg Intelligence that looked at the 60 most-held stocks.

Aside from the Swedbank Robur fund, the biggest ESG portfolio exposures to Nvidia are an $8.2 billion exchange-traded fund managed by BlackRock Inc., the iShares MSCI USA SRI UCITS (Ticker: SUAS LN). There’s also an $8 billion technology fund managed by Franklin Resources Inc. (Ticker: TEMTECI LX), according to the latest data compiled by Bloomberg.

ESG’s exposure to tech is now helping it outperform traditional funds, said Joachim Klement, a strategist at Liberum Capital. But the ESGness of such investments is worth debating, he said. That’s because the rise of AI means computing-intensive applications will rise in popularity, which implies a rise in energy consumption.

“As long as server farms and computers that perform AI applications aren’t run with renewable energy, that is bad news for the environment since the AI boom implies a larger demand for electricity generated with fossil fuels,” he said.

Across all its ESG portfolios, Swedbank AB, the parent of the unit that runs the Swedbank Robur Technology C fund, holds more than $1.4 billion of Nvidia stock, according to the latest available Bloomberg data. BlackRock’s exposure via ESG funds is about $3.6 billion in total, while Credit Agricole SA has roughly $1.8 billion through its ESG investment business.

Nvidia’s ascent to the stratosphere of tech gains has surprised even analysts who closely track the stock. As it morphs from a maker of computer-graphics chips into a company that’s at the center of the boom in AI, it’s been able to deliver market-beating sales forecasts that have seen it test a $1 trillion valuation.

Jensen Huang, Nvidia’s chief executive officer, wowed investors on Monday with a new array of products and services that showcased the company’s dominance in AI. The centerpiece was an AI supercomputer platform called DGX GH200, intended to help companies including Microsoft and Alphabet Inc.’s Google to move beyond ChatGPT.

Barrett said his strategy at Swedbank Robur is “don’t get over-excited about anything. But also don’t get too pessimistic,” he said. “Having a long-term perspective is important.”

--With assistance from Carlo Maccioni and Amine Haddaoui.