Turkey’s inflation decelerated to the slowest since 2021 as President Recep Tayyip Erdogan made good on a promise to give natural gas to households for free last month, a decision made before elections that prompted him to overhaul his economic team.

The pledge by Erdogan ahead of two rounds of voting in May was emblematic of the idiosyncratic approach he’s taken for years to steering the $900 billion economy. It mean that household gas prices were recorded as zero last month by the statistics service TurkStat, which gives the fuel a weight of just under 3% in the consumer-price basket.

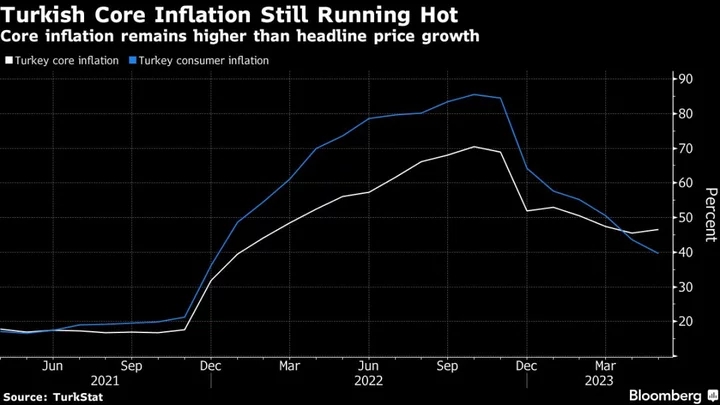

Consumer prices rose 39.6% in May from a year earlier, slightly less than forecast and compared with 43.7% in the previous month, according to data published Monday. On a monthly basis, inflation was near zero for the first time in four years.

Though annual inflation slowed for a seventh straight month since peaking near 86% in October, the relief for households is unlikely to last, with the Turkish currency coming under intense pressure to depreciate and already trading at record lows.

The lira extended losses and weakened more than 1% after the data release, trading at 21.1662 per dollar as of 11:13 a.m. in Istanbul. Goldman Sachs Group Inc. worsened its forecasts for the currency and sees it at 28 per greenback in 12 months.

And in a sign cost pressures are still elevated, core inflation — which strips out volatile items — accelerated in May and reached an annual 46.6%, from 45.5% in April.

Erdogan, who won in a runoff just over a week ago, is revamping his cabinet to win back investor confidence after years of unorthodox policies. Mehmet Simsek, Turkey’s new treasury and finance minister, said on Sunday that “the main aim would be to fight inflation on a rational basis.”

Read more: Erdogan Taps Markets Veteran Simsek as Finance Minister

Simsek, who served as a deputy prime minister and finance minister in previous Erdogan cabinets, is a former Merrill Lynch strategist respected by investors for his defense of conventional economics.

What Bloomberg Economics Says...

“While partial discounts in utilities will continue, we expect government policies and the central bank’s loose monetary policy stance, both of which are feeding into inflationary pressures, to see the inflation rate back above 40% by year-end.”

— Selva Bahar Baziki, economist. Click here to read more.

Under pressure from Erdogan, the central bank refrained from tightening monetary policy in the face of soaring inflation and cut interest rates deep below zero when adjusted for prices. The next rate-setting meeting is scheduled for June 22.

Societe Generale SA analysts said they expect a 650 basis-point hike by the central bank this month, and then two consecutive increases of half a percentage point in July and August to bring the benchmark to 25% from its current 8.5%.

“We expect that Simsek’s appointment will lead to an overhaul of monetary policy in Turkey,” SocGen analysts including Marek Drimal in a report last Friday. “The new monetary policy will aim to curb the credit expansion on the domestic side and to rebuild the country’s FX reserves drained by the intervention prior to the election.”

--With assistance from Joel Rinneby.