Electricite de France SA is set to return to full state ownership on Thursday, almost 18 years after its listing on the Paris stock exchange. Its nationalization ends a bumpy ride for shareholders but many challenges still loom large for the debt-laden nuclear behemoth.

The €9.7 billion ($10.4 billion) bill for nationalizing EDF has bought the French government the power to align the strategy of Europe’s biggest electricity producer with its own priorities — keeping power prices affordable, investing in new reactors and expanding renewables. But the utility’s baggage means the state won’t have an entirely free hand.

Faulty pipework at some reactors continues to curb output, while new plants suffer from construction delays and budget overruns. EDF’s net financial debt has become a considerable burden, soaring by 50% to €64.5 billion last year as it posted a record loss.

“EDF’s debt is a bit of a ball and chain,” said Nicolas Goldberg, a partner in charge of energy at Colombus Consulting in Paris. The company needs to fix its balance sheet to tackle “a wall of investment” on new nuclear, renewables and power networks, he said.

These are the main challenges EDF Chief Executive Officer Luc Remont will need to handle when he publishes a new business plan in the coming weeks:

Nuclear Reliability

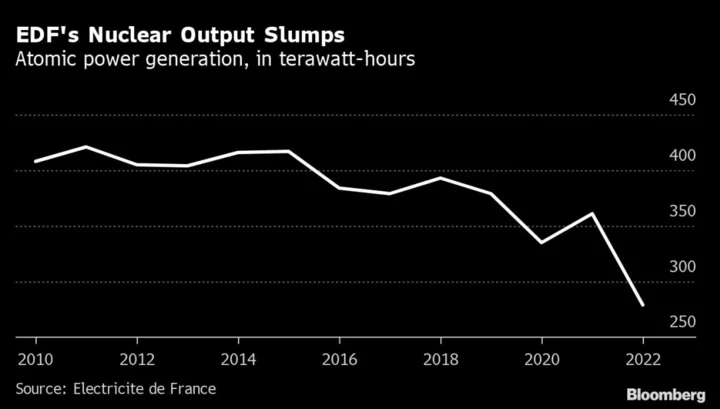

EDF’s French nuclear output plunged 23% last year to 279 terawatt-hours, the lowest since 1988 because of lengthy reactor outages to check and repair pipes affected by stress corrosion. That exacerbated Europe’s energy crisis and pushed electricity prices higher just as the French utility had to buy power on wholesale markets to cover its production shortfall, eventually costing it €29 billion.

Read more: Cracking Under Pressure: The Race to Fix France’s Nuclear Plants

Since then, EDF has made progress in replacing the faulty pipes of its reactors, but a heavy inspection regime still to come leaves room for surprises. The company expects production to be in a range of 300 to 330 terawatt-hours this year and 315 to 345 terawatt-hours next year, still a far cry from the 380 terawatt-hours generated in 2019.

“The targeted improvement in the nuclear fleet availability appears to be modest,” Celine Cherubin, senior credit officer at at Moody’s Investors Service, wrote on June 1. “The likelihood of unexpected new faults requiring immediate fixes has increased.”

Uncertain Regulations

More than a decade ago, France introduced a law that forces EDF to sell as much as 100 terawatt-hours of nuclear power annually to its rivals at €42 per megawatt hour — a steep discount to current wholesale prices — to foster competition while keeping retail prices affordable. The utility has been advocating against the legislation, which expires at the end of 2025, arguing that it deprives the company of revenue needed to invest in new reactors.

For large industrial users, EDF is seeking long-term contracts at a “significantly higher” price to cover its current costs and planned investments. Some power-hungry manufacturers have been able to pass higher energy costs to consumers, but others have warned they would become more exposed to international competition if power prices rise, according to a person familiar with the ongoing talks between EDF and the French state.

“We’re entering a period when we have to massively invest for decarbonization,” EDF’s Remont said at a conference in Paris on Thursday. Following last year’s price surge, long-term contracts are “the best way for all consumers — very large ones, and small ones — to see prices drop back,” and avoid volatility caused by external shocks like the war in Ukraine, he said.

There’s also “no difficulty” in replacing regulated tariffs for households — which currently remain largely based on outdated parameters set more than a decade ago — with a basket of contracts that more closely reflect “economic realities,” Remont said. EDF is ready to keep working with other energy suppliers as clients or partners, assuming a proper framework is set, added, he said.

The French government is offering little clarity on what will happen. It failed to reach a deal with European competition authorities over new power-price regulations in 2021 and is still seeking rules that would give it a firm grip on prices for end users.

“Question marks remain over the regulation of nuclear production from 2026 and over the financing of new nuclear projects,” said Emmanuel Dubois-Pelerin, an analyst at S&P Global Ratings. “There’s a balance to find between the producer and consumers, and this is a crucial question when investing in nuclear projects for 50 to 60 years.”

New Reactors

The shift away from fossil fuels is expected to boost electricity demand and President Emmanuel Macron has asked EDF to prepare for the construction of between six and 14 new reactors by 2050.

The company hasn’t faced a challenge on that scale in decades. Most of its current fleet came online in the 1980s and recent construction projects have veered into fiasco. Its new flagship 1,600-megawatt European Pressurized Reactor at Flamanville is due to be begin operations next year — 12 years behind schedule and with a construction cost that has quadrupled to €13.2 billion.

The budget for two similar units under construction in partnership with China General Nuclear Power Corp at Hinkley Point in the UK has almost doubled to £32 billion ($39.6 billion). Supply-chain disruption due to the Covid-19 pandemic and the war in Ukraine has delayed works and raised the prices of everything from cement to steel.

The bill for the six new EPRs with a streamlined design in France could be €52 billion, according to a government estimate given before the invasion of Ukraine. While Macron has said the state might invest tens of billions in the program, the government has asked for a fresh review of the projects and financing is still under discussion.

Add in spending on maintenance, lifetime extension of existing reactors, renewables and power networks, then EDF will need to keep investing more than €16 billion each year. Before this can happen the government and the company “must find a regulatory system where risks are shared between the state and EDF,” said Goldberg, the Colombus consultant.

(Updates with comments of EDF’s CEO from 11th paragraph.)