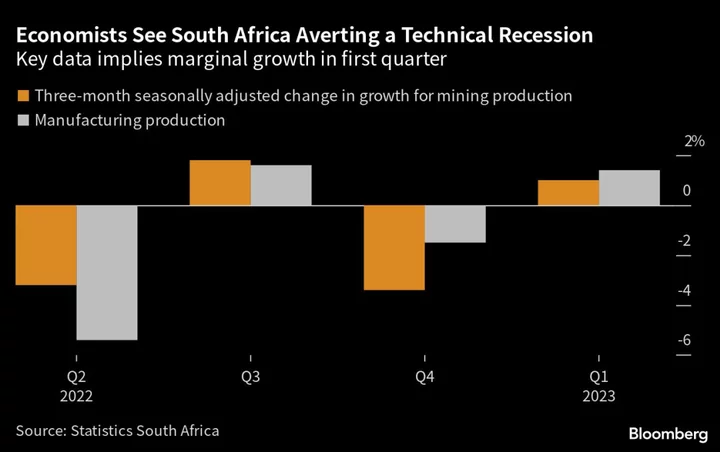

South Africa’s economy probably avoided a technical recession in the first quarter, despite more intense power outages.

A median estimate of seven economists in a Bloomberg survey conducted May 5-11 is for a quarterly gross domestic product expansion of 0.2%, compared with 0.1% forecast in April. The BankservAfrica Economic Transactions Index, an early indicator of economic activity, has however signaled the probability of a negative quarter-on-quarter number for the first three months of 2023 after GDP contracted 1.3% in the final quarter of last year.

Better-than-expected mining and manufacturing output likely contributed to growth in the quarter, counteracting negative contributions from new-vehicle sales and electricity generation, Thanda Sithole, senior economist at FirstRand’s First National Bank Senior, said in a research note on Thursday. Mining and manufacturing make up more than a fifth of total GDP.

The statistics agency is scheduled to publish GDP data for the first quarter on June 6.

Economic growth would have been stronger without the rotational blackouts that are being implemented by the state power utility. Eskom Holdings SOC Ltd. implemented electricity rationing on 89 days in the first quarter, the same as the prior three months, but at a higher intensity. The company, which produces almost all of South Africa’s electricity, has struggled to meet demand since 2008.

The central bank forecasts that power cuts will shave 2 percentage points off GDP growth this year and has contributed to the depreciation of the rand, which has stoked inflation. The currency has declined more than 11% in 2023, making it the second-worst performing emerging-market currency against the dollar after Argentina’s peso, of those tracked by Bloomberg.

The central bank has jacked up borrowing costs by 425 basis points over the past 18 months to contain inflation that at 7.1% remains above the 4.5% midpoint of the target range at which it prefers to anchor price-growth expectations. It predicts headline inflation will remain elevated, reaching the middle of the target range only in 2025.

The median estimate of 14 economists in the survey is for the central bank’s monetary policy committee to end its tightening cycle at its May 25 meeting with a 25 basis-point hike. Forward-rate agreements used to speculate on borrowing costs show traders are pricing in the possibility of almost a full 50 basis-point increase at the May MPC meeting, and 25 basis points at the next one in July.