Economists appear to see a greater possibility of the Bank of Japan adjusting policy in the near-term than many market players in a reversal of the status quo of the past year when speculators betted heavily on the central bank joining a global wave of policy tightening.

Around two-thirds of economists said they expected the central bank to tighten policy by July in an April survey by Bloomberg. While many of those calls have been pushed back since then, Goldman Sachs and BNP Paribas are among those expecting a policy tweak next month.

With inflation at 3.4% after more than a year exceeding the BOJ’s 2% target, the central bank’s current forecast of 1.8% core inflation in the 12 months through March looks very cautious. A sharp bumping up of that projection in July could provide justification for an adjustment with relatively benign market conditions favoring a surprise move, some economists argue.

By contrast, market pricing suggests investors see little in store over the coming months as BOJ Governor Kazuo Ueda’s dovish messaging gains traction.

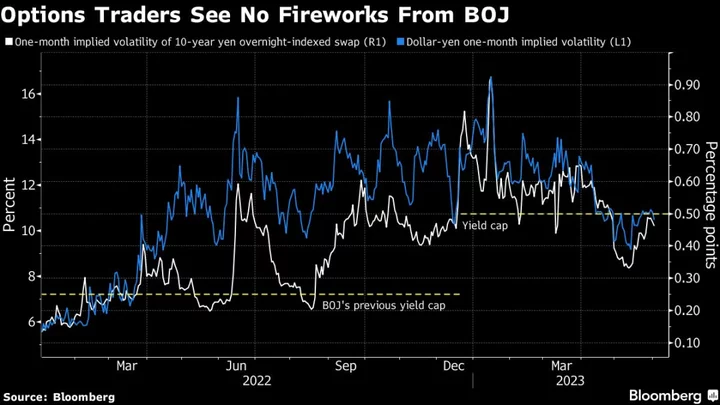

One-month implied volatility in 10-year overnight swaps and the dollar-yen exchange rate are well below sharp peaks in January, indicating that options traders expect no major BOJ policy shift that can jolt the markets for the time being.

Japan’s benchmark Nikkei 225 Stock Average index hit the highest level in 33 years earlier this week and the yen weakened to a six-month low partly due to market expectations that the BOJ will continue with monetary easing.

Financial sector jitters in the spring, the winding down of a worldwide wave of interest-rate hikes and the possibility of an early election in Japan are among the possible factors swaying market participants.

But Ueda’s cautious messaging has likely been the key influence.

Since taking the helm in early April, the new governor has signaled the need to continue easing with yield curve control for now and to be wary of the “extremely high” cost of any premature withdrawal of stimulus. That’s a long way from expectations before his appointment that the new BOJ leadership would quickly embark on an agenda for change.

At his first meeting as governor in late April, Ueda called for a review of up to 18 months into the measures used over the past quarter century. For Tsuyoshi Ueno, senior economist at NLI Research Institute, that shows the governor is looking to carefully examine the BOJ’s toolkit before taking major action.

“It’s not that financial markets are ignoring a chance of early YCC tweaks,” Ueno said. “It’s they don’t think they would have an enormous impact given Ueda has strongly indicated monetary stimulus is here to stay.”

In other words, a surprise hike in the yield cap in December was viewed as a precursor to more substantial change in the pipeline, but a similar move in July may not be interpreted in the same way.

“Tweaking YCC by ending the cap on yields or a similar move could be taken as a positive as it would enhance the sustainability of easing,” said Hiroshi Miyazaki, senior economist at Mizuho Research & Technologies.

The BOJ has also helped suppress bets against it. The central bank, the majority holder of JGBs in the market, quadrupled in February the minimum fee it chargers brokers to borrow recently issued 10-year bonds, effectively jacking up the price of shorting.

In markets there’s always the possibility that investors may quickly adjust their positions if the mood changes in the run-up to meetings over the coming months.

Still, some BOJ watchers warn that any early move would damage Ueda’s messaging credibility.

Naomi Muguruma, chief fixed-income strategist at Mitsubishi UFJ Morgan Stanley Securities, sees Ueda waiting until the fourth quarter before ending YCC.

“The BOJ won’t take action that contradicts what they have been repeatedly saying for the last month or two,” she said. “That would have an impact on the credibility and the central bank’s communication ability.”

--With assistance from Masaki Kondo.