Economists see India’s central bank holding interest rates this year before cutting 25 basis points in the first quarter of next year as inflation moderates and the economy stays resilient, according to the latest Bloomberg survey results.

The benchmark repo rate is currently at 6.5% and the estimate for a quarter-point cut in January-March 2024 compares with a previous projection of a 50 basis point reduction. The rates could be lowered again in the following quarter, bringing the levels to 6%.

Policy makers from the Reserve Bank of India will meet June 6-8 to deliberate and economists are expecting another hold in rates as the central bank focuses on growth while inflation shows signs of moderating.

“For the upcoming MPC meeting, we are expecting RBI to hold the rates at 6.50%,” said Ritika Chhabra, a quant portfolio strategist at Prabhudas Lilladher. “We are not expecting any rate cuts this calendar year. Inflation is expected to be 5% for the current fiscal year. However, there are upside risks to this forecast in case we experience below average rainfall.”

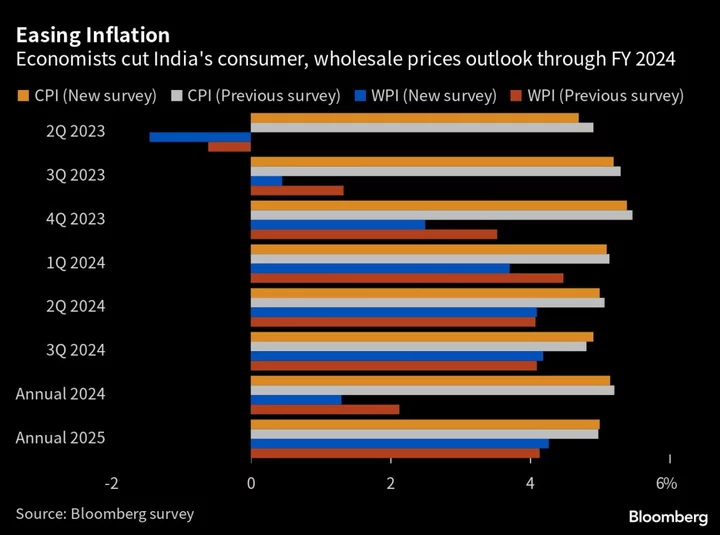

India’s retail inflation is expected to trend lower through to the second quarter this year due to a slower momentum in prices while taking into account the base effect.

Consumer prices will likely ease to 4.7% in the second quarter, with the 2023 forecast lowered to 5.15% from 5.21% previously. Wholesale price deflation for the quarter ending June is set to deepen to 1.45% from 0.61%, before going back to inflationary phase in the July-September period at 0.45%.

March was the first month this year so far where India has seen a retail inflation reading below the 6% upper tolerance limit set by the RBI. In an attempt to rein in prices, the central bank hiked the benchmark repurchase rate by 250 basis points cumulatively over a year before going for a pause in April.

With growth remaining relatively resilient even as inflation moderates, the central bank will keep rates on hold, said Michael Wan, an analyst at MUFG Bank.

“The risks around our policy rate forecasts are balanced,” he said. “Inflation could come in higher than expected due to a deficient monsoon or a spike in oil prices, but on the flip side, this has to be balanced with the potential negative impact on growth as well.”