Unmoved by recent signs that inflation pressure is abating, economists continue to predict that the European Central Bank will deliver one final increase in interest rates next month.

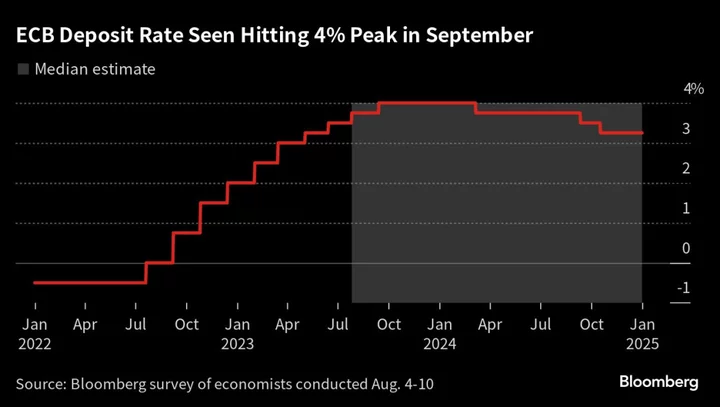

The deposit rate will be lifted to 4% in September from 3.75% now, a Bloomberg poll showed. At the same time, respondents reckon officials will start cutting borrowing costs in March, a month earlier than they previously thought.

The results come as major central banks ponder the end of their more than yearlong rate-hiking campaigns. President Christine Lagarde has said the ECB’s Sept. 13-14 meeting will be between a 10th straight increase and a pause.

Since officials last convened, ECB research has suggested that underlying inflation — a metric they’ve been keenly watching — has probably peaked. What’s more, a separate poll of consumers revealed that expectations for price growth across the 20-nation euro zone dropped further, though remained above the 2% goal.

Analysts in the Bloomberg survey, however, boosted their projections for inflation in 2023, and for core inflation this year and next. And a market measure of price gains is testing record highs.

Money markets currently price a 70% chance of a 25 basis-point ECB hike next month.

Aside from inflation, warnings about economic weakness are getting louder. Executive Board member Fabio Panetta this month urged prudence “in calibrating our monetary-policy stance if we are to reach our inflation target without harming economic activity unnecessarily.”

While the euro area has so far dodged a recession and is likely to continue doing so, its biggest member — Germany — suffered a winter downturn and stagnated in the second quarter. Economists expect another quarter of zero growth in the three months through September and still see German output shrinking by 0.3% this year, with the outlook for 2024 also shifting down to 0.8% from 1%.