The European Central Bank will hold interest rates at their peak for longer than previously thought as underlying inflation pressures persist, according to economists polled by Bloomberg.

The first cut in the deposit rate, which is still seen hitting a high of 3.75% in the summer, is now anticipated in the second quarter of 2024, compared with earlier predictions for the first, the survey conducted May 5-11 showed.

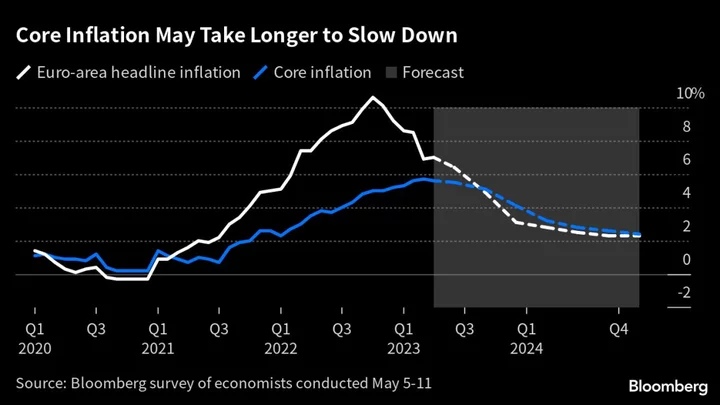

Accompanying that scenario are expectations for core inflation, which strips out volatile items and is currently officials’ favored price gauge, to take longer to abate and remain at 2.4% in the fourth quarter of next year — well above the 2% official target for overall price gains.

The results underscore the concern among many policymakers over the enduring nature of underlying inflation. The ECB raised its deposit rate by 25 basis points to 3.25% this month, pledging to push borrowing costs to “sufficiently restrictive levels” and keep them there for “as long as necessary” to bring prices under control.

Some officials have started pushing back against market bets that rates could be lowered as soon as next spring. Latvian central-bank chief Martins Kazaks said in an interview last week that such wagers were “significantly premature.”

He and others say the quarter-point increases in June and July that most analysts predict may not suffice to defeat inflation conclusively. Bundesbank President Joachim Nagel said Friday that the ECB may need to keep tightening policy “beyond the summer break.”

Stubborn underlying price pressures could push others in that direction. Executive Board member Isabel Schnabel has said rates should continue to rise “until there are signs that core inflation is also falling on a sustained basis.”

Economists continue to expect a gradual economic recovery in the euro area, with the rate of expansion gradually picking up to 0.4% in the second half of next year.