European Central Bank officials sparring over when to conclude their historic bout of interest-rate increases will get vital face time to smooth out any differences at their annual retreat this week.

Having lifted borrowing costs by 400 basis points since they last assembled in the Portuguese hillside resort of Sintra, President Christine Lagarde and her colleagues are unsure about how much more they must do to get inflation securely on the road back to 2%.

Another hike in July is all but guaranteed. The question is whether a pause is then warranted to appraise the still-unfolding effects of policy tightening to date, or whether more action is required after the summer break to tackle stubborn underlying price gains.

“The two key elements of debate are the time lags of monetary policy, which the doves will be pushing, and the fact that core inflation just remains very sticky, which the hawks will be pushing,” said Mohit Kumar, an economist at Jefferies. “It’s a very fine line between who wins.”

Weighing on their minds will be recent signs of economic weakness within the 20-nation euro zone, which has already suffered a mild recession.

Germany is perhaps the biggest concern: data Monday showed its business outlook deteriorated to the lowest this year as it struggles to cement a recovery following its own recent downturn.

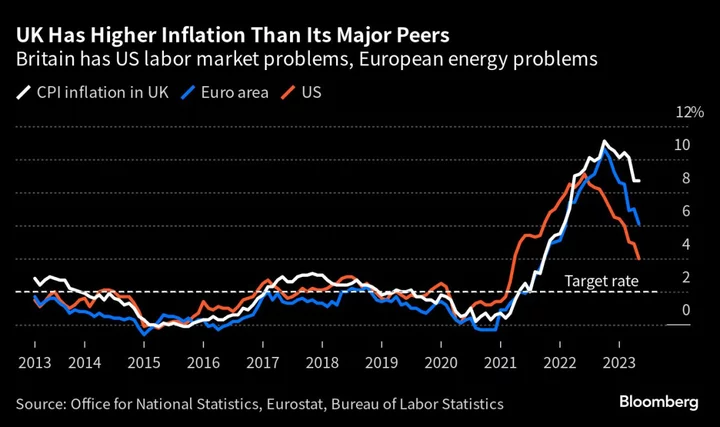

Developments beyond mainland Europe have been worrying, too. Sticky inflation has left the Bank of England locked firmly in hiking mode, even as a mortgage crisis looms. In the US, the Federal Reserve is signaling more rate increases are likely — despite holding fire at its last meeting.

Most economists expect July’s rise in the ECB’s deposit rate, to 3.75%, to be the last. But after projections for medium-term price growth were revised up a touch this month, more are starting to predict another quarter-point step at the following meeting, in September.

Markets are also leaning toward that scenario, though investors don’t appear to be contemplating moves even further into the future. That’s a prospect that’s only been flagged by Belgian central bank chief Pierre Wunsch, who fears underlying inflation may not abate as quickly as hoped.

What Bloomberg Economics Says...

“Underlying inflation is cresting, but too late for Lagarde and her colleagues at the ECB to stop hiking this summer. Tight monetary policy will result in an economy on the brink of stagnation this year, and sticky core inflation means we don’t see a rate cut until mid-2024.”

—Jamie Rush and Maeva Cousin. Read the full note here

“The focus is on the core rate because that’s where the biggest uncertainty is, but also because it’s what’s most important to get the threat of a higher longer-term dynamic under control,” said Dirk Schumacher, an economist at Natixis. “If the core rate declines in the next three months, the doves will say all conditions have been met” to stop rate hikes.

That may prove a high bar. Germany’s decision to offer ultra-cheap public transport last summer is set to exert upward pressure on core inflation between June and August. Its effect will be seen later this week, when the biggest euro-zone countries and the 20-nation bloc itself release inflation data for this month.

Another strong tourism season and record-low unemployment will also underpin price gains, according to Ulrike Kastens, an economist at asset manager DWS.

“I don’t see much scope for core inflation to slow below 5% if I look at services and what’s in the pipeline,” she said. “Developments around the labor market and wages are trumping other arguments at the moment.”

Bank of France Governor Francois Villeroy de Galhau has been a noticeable moderate voice of late, insisting the ECB has completed most of its hiking and that transmission takes about two years. Chief Economist Philip Lane is of a similar mind, cautioning against premature decisions on September.

“It’s very important to recognize that monetary policy plays out over quite a long period of time,” he said Friday in a podcast. “Should we continue to raise interest rates, it makes sense to go step by step, because there’s a lot of uncertainty out there.”

Yet the global backdrop — particularly in Britain — points to a sense of alarm over inflation’s unyielding nature, with Bundesbank President Joachim Nagel describing it last week as a “greedy beast.”

Chewing over that and other topics at Sintra — the euro zone’s version of the Fed’s annual Jackson Hole gathering — will be Fed Chair Jerome Powell, BOE Governor Andrew Bailey and Bank of Japan Governor Kazuo Ueda.

- Follow Wednesday’s TOPLive Blog on the Sintra panel with Lagarde, Powell, Bailey and Ueda here

Papers up for deliberation at the get-together cover supply shocks, fiscal policy and the ECB’s balance sheet, which has been declining but — at more than €7 trillion ($7.6 trillion) — remains huge by historical standards.

There’ll also be a debate about economic forecasts, which were way off the mark as the pandemic reopening and Russia’s attack on Ukraine sent prices soaring.

Most of the attention, however, will be on where euro-area rates may settle. While a survey of analysts suggested the ECB will deliver exactly the right dose of tightening, Deutsche Bank AG’s chief economist, David Folkerts-Landau, told Bloomberg Television that a 4% peak wouldn’t be surprising as wage-price dynamics keep inflation higher for longer.

Indeed, the final stages of the cycle may yet be the toughest.

“It was pretty easy to do monetary policy up until now,” Nagel said. “Now, the art of monetary policy is starting.”

--With assistance from Niraj Shah (Economist), Craig Stirling and Francine Lacqua.

(Updates with German Ifo, economist starting in sixth paragraph.)