The European Central Bank may see inflation returning to its 2% target sooner than currently forecast, considering the fragile state of the economy, according to Clara Raposo, vice governor of the Bank of Portugal.

While Raposo said she’s “not pessimistic” about the outlook, she expressed concern that dwindling export demand could further weigh on an economy already struggling to grow.

With inflation slowing markedly and the effect of past ECB interest-rate increases still in the pipeline, she would have preferred to keep borrowing costs on hold last week.

“We must get inflation back to target, that’s our No. 1 objective,” Raposo said in an interview in Santiago de Compostela, Spain, where she attended a meeting of European finance chiefs. “It’s on its way, and core inflation is coming down at last. If the economy decelerates a little bit more — and that’s possible — maybe we get there sooner than some of the projections suggest.”

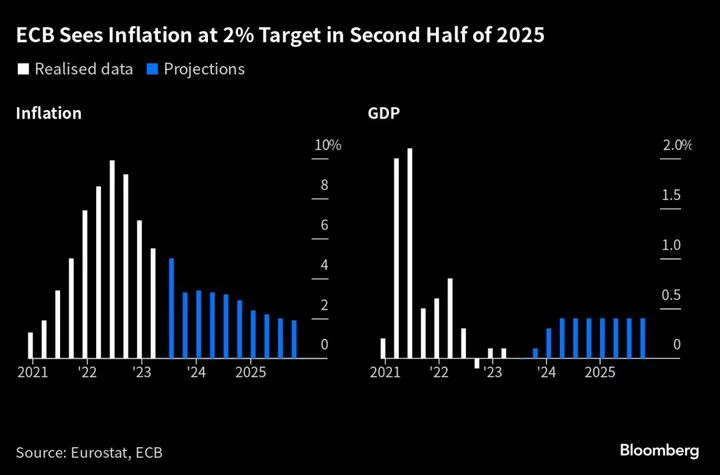

The ECB raised borrowing costs last week for a 10th straight time and published fresh economic projections that show inflation hitting 2% in the second half of 2025. The outlook was completed before data revealed that expansion in the three months through June was much weaker than initially thought.

“So far, the euro-zone economy has been quite resilient,” Raposo said. “But we’re going through a lot of pressure on external demand. Relations with China have become more tense lately, and we should be paying attention since that could lead to a reduction in demand and make our stagnation more serious than we’d anticipated.”

It’s crucially important for the ECB to understand exactly where price pressures are coming from and how rate hikes are transmitted into the economy, Raposo said, adding that the Governing Council spent a lot of time at its last meeting to discuss these issues.

Raposo, 52, has been a Banco de Portugal vice governor since December. She’s in charge of financial stability and markets at the institution and also regularly attends the ECB Governing Council with Governor Mario Centeno.

“If you ask me, I would have preferred a pause this time,” she said. “The signs are all here: core inflation is down and headline inflation has been halved, exports are slowing down, employment growth is also lower, and credit decelerated.”

She added that “what makes me hesitant is that I’m not sure we have seen enough of the impact of previous hikes just yet — we need to look into the transmission mechanism very seriously.”